Accounts Payable

Bookkeeping Professionals since 2001. Give us a call & join our family of happy clients.

Be assured with our 30 day money back guarantee.

We are ready to chat wITH YOU!

Learn More About How We Can Help With Accounts Payable

Complete Accounts Payable Solution

Keeping accounts payable financial processes and paperwork up-to-date and accurate can be a challenge. Particularly if you are a business that has multiple suppliers, or that orders frequently, working out how much you owe and the timeline for payment can be difficult. Geekbooks provides a professional, experienced accounts payable process, enabling you to manage your creditors as well as gain access to the financial forecasts and real-time information needed for good decision making. With prices starting from as little as $25/hour for our bookkeeping services, as well as a no-hassle, 30-day money-back guarantee, there’s never been a better time to try our bills payable service and see how it can help your business.

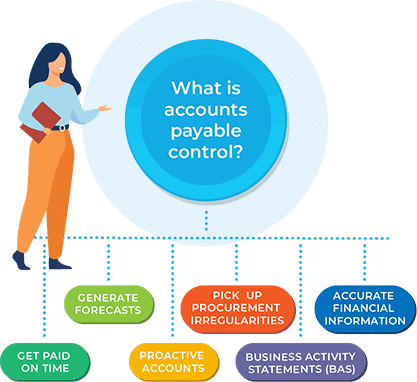

What is Accounts Payable Control?

Every business requires purchases in order to operate. From utilities through to tools, fuel for corporate vehicles, materials, travel costs or stationery, your enterprise is both a vendor to customers and a customer in its own right. Accounts payable are the accounts which a business has with its suppliers. Some accounts payable will be settled on a monthly basis; others will be ad hoc purchases; or larger amounts which are to be paid on an instalment plan. Keeping track of how much is owed and when it needs to be paid is essential in order to:

Paid on time

Make sure that there is sufficient cash in your business account to pay each invoice at the appropriate time.

Ensure invoices are paid on time to prevent late penalties or suspension of supply.

Forecast

Generate financial forecasts, based on your current situation. It can be tempting to treat the amount of money in the business account as money that’s actually available to spend or invest: the reality is that much of it may already be spoken for once the bills are paid. Financial forecasts and an up-to-the-minute picture of your current financial position can make it easier to plan spend appropriately.

Proactive Accounts

Build up a picture of spend over time. Particularly for smaller businesses that have limited bookkeeping input, it can be all too easy for unnecessary expenditure to rise. Perhaps additional expense items are generated, or goods have been ordered that don’t offer the best value. Pro-active accounts payable control can ensure these matters are picked up early on so that they can be dealt with in a timely manner.

Procurement Regularities

Pick up procurement irregularities. There are all sorts of reasons why supplier invoices may be incorrect, such as over-ordering; inappropriate substitutions; items charged for which have not arrived; or other errors. A scheduled finance check will pick up any inconsistencies, enabling queries to be chased with the supplier in question, and a suitable resolution found.

Business Activities Statements

Inform Business Activity Statements (BAS) and tax predictions. Accurate accounts payable make it easier to collate the information needed for ATO reporting requirements. Using the right accounts payable software on a regular basis results in consistent, high-grade data that is easy to review and utilise when it’s time to create documentation for the ATO.

Accurate Financial Information

Provide accurate financial information. Accounts payable can have a major impact on your bottom line. Many customers find that once their accounts payable cycle is in order, it is much easier to work out how well their business is performing.

What Do We Offer?

We are a team of online bookkeepers who offer a complete bookkeeping solution, including accounts payable to businesses across Australia. Our staff work remotely, which means we can deal with your bookkeeping no matter where you’re located. Strong on privacy, our secure data transfer mechanisms and high-grade software protects your data and that of your customers and suppliers. Responsive, pro-active, knowledgeable and fast, we are able to get your accounts payable into shape quickly. Ask us about our competitive rates – from as little as $25/hour.

If you purchase bookkeeping services from us, you can expect to benefit from:

A customised service

We understand that cost and value are both priorities for our customers. Particularly in smaller businesses, where every cent matters, it's vital that we offer targeted bookkeeping that will deliver optimum impact for minimal expenditure. When you use us for your bookkeeping, we will help you to identify the key tasks which need completing to ensure your company operates legally and profitably. Remember that our prices start from just $25/hour. As we work quickly and know what we're doing, it's surprising how much we can get done in just a few hours each month.

The services of an experienced team of bookkeepers

With decades of relevant experience between us, we have amassed a broad knowledge of problem-solving and the creation of robust, sustainable financial processes in a wide range of organisations. What this means is that we are able to work effectively with your business, no matter what type it is or what stage it's at. We are structured to work particularly well with fledgeling businesses, or smaller enterprises.

Building capacity in your organisation

Many of the companies that we work with are smaller organisations such as sole traders, owner-operators or new companies that only have a year or two of trading under their belts. Frequently, owners start off by doing bookkeeping themselves. This is fine in the initial stages of the business beginning to trade, but becomes ever more onerous as trade begins to pick up. When you use us, we are able to work with you to show you processes, software and techniques that will make it easier and less time-consuming to keep up with your bookkeeping. If you already employ a member of staff to deal with your financial matters, we can work with them to optimise the financial systems and processes you have in place.

A commitment to saving you money

One of the main aims of bookkeeping is to make it easier for businesses to save. When your financial information is in good order, it's easier to meet ATO deadlines, avoiding costly penalties. It's also easier to make accurate financial forecasts and gain a good insight into how your business is performing. Having high-grade financial information at your finger-tips provides the data needed for sound decision-making. Having clear information on accounts payable allows companies to spot discrepancies and note where the best value isn't being achieved. This enables businesses to take prompt action to sort out problems as they occur. We keep our charges competitive: depending on the type of package you select from us, you can expect to pay as little as $25/hour for our bookkeeping services.

We work around your needs

If you just need us as a one-off, perhaps to simply get your accounts payable in order, we can do it. Alternatively, if you need a greater variety of bookkeeping services, or require on-going support, we can do that too! We offer responsive bookkeeping that's tailored to meet your needs. Just tell us what you need, then let us provide the friendly, fast, expert input required to deliver the results you're looking for.

Experience in most sectors

We understand that a retail business has a very different pattern of accounts payable to a notfor-profit, for example. Our team has worked with farmers, engineering enterprises, offices, service industries, university books, hospitality businesses, care enterprises, clinicians, pharmaceutical providers and more. This enables us to bring industry-specific understanding and knowledge to your accounts payable.

If you purchase bookkeeping services from us, you can expect to benefit from:

A customised service

We understand that cost and value are both priorities for our customers. Particularly in smaller businesses, where every cent matters, it's vital that we offer targeted bookkeeping that will deliver optimum impact for minimal expenditure. When you use us for your bookkeeping, we will help you to identify the key tasks which need completing to ensure your company operates legally and profitably. Remember that our prices start from just $25/hour. As we work quickly and know what we're doing, it's surprising how much we can get done in just a few hours each month.

The services of an experienced team of bookkeepers

With decades of relevant experience between us, we have amassed a broad knowledge of problem-solving and the creation of robust, sustainable financial processes in a wide range of organisations. What this means is that we are able to work effectively with your business, no matter what type it is or what stage it's at. We are structured to work particularly well with fledgeling businesses, or smaller enterprises.

Building capacity in your organisation

Many of the companies that we work with are smaller organisations such as sole traders, owner-operators or new companies that only have a year or two of trading under their belts. Frequently, owners start off by doing bookkeeping themselves. This is fine in the initial stages of the business beginning to trade, but becomes ever more onerous as trade begins to pick up. When you use us, we are able to work with you to show you processes, software and techniques that will make it easier and less time-consuming to keep up with your bookkeeping. If you already employ a member of staff to deal with your financial matters, we can work with them to optimise the financial systems and processes you have in place.

A commitment to saving you money

One of the main aims of bookkeeping is to make it easier for businesses to save. When your financial information is in good order, it's easier to meet ATO deadlines, avoiding costly penalties. It's also easier to make accurate financial forecasts and gain a good insight into how your business is performing. Having high-grade financial information at your finger-tips provides the data needed for sound decision-making. Having clear information on accounts payable allows companies to spot discrepancies and note where the best value isn't being achieved. This enables businesses to take prompt action to sort out problems as they occur. We keep our charges competitive: depending on the type of package you select from us, you can expect to pay as little as $25/hour for our bookkeeping services.

We work around your needs

If you just need us as a one-off, perhaps to simply get your accounts payable in order, we can do it. Alternatively, if you need a greater variety of bookkeeping services, or require on-going support, we can do that too! We offer responsive bookkeeping that's tailored to meet your needs. Just tell us what you need, then let us provide the friendly, fast, expert input required to deliver the results you're looking for.

Experience in most sectors

We understand that a retail business has a very different pattern of accounts payable to a notfor-profit, for example. Our team has worked with farmers, engineering enterprises, offices, service industries, university books, hospitality businesses, care enterprises, clinicians, pharmaceutical providers and more. This enables us to bring industry-specific understanding and knowledge to your accounts payable.

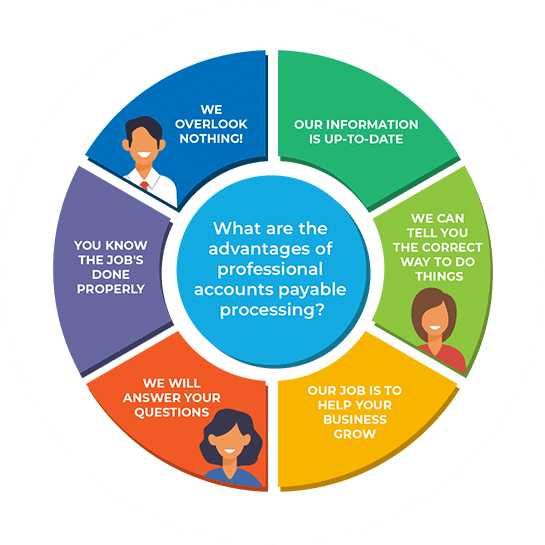

What are the Advantages of Professional Accounts Payable Processing?

Honest, Highgrade, Professional Results

30 Day Satisfaction Guarantee

$25/Hour Package

You know the job’s done properly

You know the job's done properly. Even business owners with a good grasp of bookkeeping basics can find it harder to deal with the more sophisticated aspects of the job. We are senior bookkeepers with lots of experience; used to dealing with any bookkeeping which comes our way, we are able to work on complex, challenging bookkeeping issues that can leave amateurs baffled!

We overlook nothing

Bookkeepers are meticulous and detail-orientated by nature. We will go through your accounts payable information line by line, checking each part of every entry to ensure accurate record-keeping. As well as dealing with current purchasing invoices, we are also able to check historic data for errors or omissions. Whatever we do, you can be confident that ATO won't find fault with it.

Our Information is up to date

ATO and other financial reporting requirements change over time. In addition, fresh initiatives and policies create further change. We keep our finger on the pulse of financial affairs: if the government announces a change, we'll make sure we know about it. Using us ensures your financial records are fit for purpose.

We can tell you the correct way to do things

Many business owners come up with their own, organically grown finance systems. In the longer term, these may not be sustainable. Our team is able to help you put in place suitable systems to ensure the generation of robust, accurate data. We are committed to making your life easier! Many of our customers are amazed at how easy and convenient we make it for them to keep on top of their accounts payable. Please get in touch to find out more about our capacity building - costs start at just $25/hour. Use our 30-day money-back guarantee to see the difference we can make.

Our job is to help your business grow

We are bookkeepers with a strong accounting background. This enables us to not only generate timely financial information but also provide suggestions for interpreting it. Knowing how much money you're paying out, and how much you've got coming in, is critical for successful business management. We want your business to succeed: by putting our professional expertise at your disposal, we hope to provide an enterprise with the data needed to grow.

We will answer your questions

Our team operate in a friendly, open and transparent manner. We recognise that every business wants to do things a little differently - our goal is to come up with a bookkeeping system that works for you. We value your questions and will always do our best to find the answers that you need. You will see the difference! Professional bookkeeping really does make a positive difference. Use our 30-day money-back guarantee to test our services and see the benefits for yourself!

Who Are Our Accounts Payable Services Suitable For?

We offer online bookkeeping services that are suitable for almost any business. We tend to work mainly with SMEs, fledgeling businesses and start-ups. Our speciality is high-value bookkeeping input that's flexible, responsive and competitively priced. With some packages available for as little as $25/hour, we strive for accessibility to all. Would you like to have an established, well-organised accounts payable cycle? We can help. Get in touch now to find out more about our services, or to take advantage of our money-back guarantee when you try one of our competitively priced bookkeeping packages.

Your Questions Answered

Accounts payable (AP) is a financial term that refers to the money owed to suppliers or vendors for products or services acquired on credit. The total amount of any and all outstanding payments one organisation owes to its suppliers is reported as the balance of accounts payable on the company’s balance sheet. The cash flow statement will show the growth or reduction in total AP from the previous quarter.

Paying close attention to your AP expenses and establishing internal controls to protect your assets and cash plays a vital role in preventing paying for incorrect invoices. Maintaining an organised and well-run accounts payable process is critical to staying informed about the impact AP has on your bottom line.

Accounts payable (AP) is a financial term that refers to the money owed to suppliers or vendors for products or services acquired on credit. The total amount of any and all outstanding payments one organisation owes to its suppliers is reported as the balance of accounts payable on the company’s balance sheet. The cash flow statement will show the growth or reduction in total AP from the previous quarter.

Paying close attention to your AP expenses and establishing internal controls to protect your assets and cash plays a vital role in preventing paying for incorrect invoices. Maintaining an organised and well-run accounts payable process is critical to staying informed about the impact AP has on your bottom line.

Accounts payable (AP) is a financial term that refers to the money owed to suppliers or vendors for products or services acquired on credit. The total amount of any and all outstanding payments one organisation owes to its suppliers is reported as the balance of accounts payable on the company’s balance sheet. The cash flow statement will show the growth or reduction in total AP from the previous quarter.

Paying close attention to your AP expenses and establishing internal controls to protect your assets and cash plays a vital role in preventing paying for incorrect invoices. Maintaining an organised and well-run accounts payable process is critical to staying informed about the impact AP has on your bottom line.

Accounts payable (AP) is a financial term that refers to the money owed to suppliers or vendors for products or services acquired on credit. The total amount of any and all outstanding payments one organisation owes to its suppliers is reported as the balance of accounts payable on the company’s balance sheet. The cash flow statement will show the growth or reduction in total AP from the previous quarter.

Paying close attention to your AP expenses and establishing internal controls to protect your assets and cash plays a vital role in preventing paying for incorrect invoices. Maintaining an organised and well-run accounts payable process is critical to staying informed about the impact AP has on your bottom line.

Accounts payable (AP) is a financial term that refers to the money owed to suppliers or vendors for products or services acquired on credit. The total amount of any and all outstanding payments one organisation owes to its suppliers is reported as the balance of accounts payable on the company’s balance sheet. The cash flow statement will show the growth or reduction in total AP from the previous quarter.

Paying close attention to your AP expenses and establishing internal controls to protect your assets and cash plays a vital role in preventing paying for incorrect invoices. Maintaining an organised and well-run accounts payable process is critical to staying informed about the impact AP has on your bottom line.

Testimonials

Geekbooks has helped

Thanks to the team at Geekbooks, I can now finally focus my attention on working on my business, not in my business. From managing invoices to chasing up outstanding payments, Geekbooks has helped me so much. They are friendly, easy to work with and just make it happen. Thanks guys.

Gunjan

True Professionals

I recommend Geekbooks as true professionals whom have the experience to handle any situation from the simplest bookkeeping to preparing books for accountants use or auditing. Since engaging with Geekbooks they have helped my business grow and taken the pressure off me so I have more time to run my business as I should be. I have the utmost confidence in referring clients to Geekbooks.

Gerard

Managing the Books

We have been using Geekbooks bookkeeping services since the end of 2017. They have really taken the stress out of managing the books, as no request is too small or too big. They are quick, efficient and professional and my business would not be in the position it is in now if I didn’t have them backing me every single step of the way. Weekly payroll is now a stress free day for me as all I need to do is send a report of hours worked for employees and they calculate the rest. Never been so stress and hassle free in my life since when I signed up with Geekbooks.

Prakash Automotive Services