Accounts Receivable and Debtor Management Services

Accounts Receivable and Debtor Management Services

Be assured with our 30 day money back guarantee.

We are ready to chat wITH YOU!

Learn More About How We Can Help With Accounts Receivable and Debtor Management

Accounts Receivable and Debtor Management Services

Running a business, however small, is extremely time-consuming. Here at Geekbooks, we appreciate that with everything else on your agenda, it’s hard to find the time to chase up debtors. However, failing to do this means you can end up with overdue invoices, and it’s your business that will suffer, not theirs. Delayed payments are one of the major drawbacks that may prevent your business from moving to the next level and have the potential to cause serious cash flow concerns.

By investing in Geekbooks’ accounts receivable and debtor management services, you can have access to our team’s extensive knowledge and expertise developed due to having helped small business across Australia. We utilise our skillsets to address your business needs, for example, chasing up late payments from debtors and tracking outstanding invoices. Without having to do these tedious tasks yourself, your time can be better spent elsewhere, such as making plans for your business’ future.

What is Accounts Receivable?

Accounts receivables are the payments that your company should receive from anyone who has purchased your goods or services. If your company has receivables, you’ve successfully made a sale, but are still awaiting payment for this.

What is Debtor Management?

Debtor management is the process of keeping track of and following up with anyone who owes your business money. Without effective debtor management, your cash flow will suffer, which leaves you vulnerable to losses. Small businesses tend to be guilty of not establishing an appropriate management system – this is where Geekbooks can help.

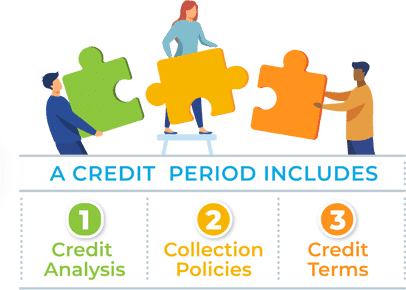

What is a Credit

Period?

A credit period is the amount of time that the customer is permitted to wait before paying you an invoice. In most cases, the credit period is short, normally ranging from a few days to a couple of months. For longer, more established clients, larger businesses may choose to increase their credit period up to a year. There are three essential components of a credit period:

A credit period is the amount of time that the customer is permitted to wait before paying you an invoice. In most cases, the credit period is short, normally ranging from a few days to a couple of months. For longer, more established clients, larger businesses may choose to increase their credit period up to a year. There are three essential components of a credit period:

1. Credit Analysis

This shows the credit-worthiness of a customer and can be done using financial analysis strategies.

2. Collection Policies

This includes any methods used by the specific company for accounts receivable recoveries. It will also acknowledge any late fees if the payment is completed late.

3. Credit Terms

This is the final stage which mentions the official credit period, calculated using their formula of sales.

An easy way to work out an optimum credit period for a client is their average accounts receivable divided by (net credit sales/days.)

Alternatively, it can be calculated by dividing the receivable turnover ratio by the number of days.

Why Choose Geekbooks’ Accounts Receivable and Debtor Management Services?

Our services are completely tailored to you, and the last thing we want is for you to lose out on any money that is owed to your business. Our accounts receivable management services aim to protect your business relationships and secure your assets. We have a dedicated and professional team of strategists who can assist in creating a tailored and fool-proof debt management plan using top-quality, specialised products and systems.

Whether you are a start-up business or one that's been around for a while, our seasoned bookkeepers can bring order, clarity and accuracy to your accounts payable system. Why not take advantage of our 30-day money-back guarantee and request a no-obligation trial? Our packages of support are competitively priced, starting from just $25/hour.

Our services include

Customer service is at the core of our services, and we will personally ensure that our clients have a clear and concise idea of the cash flow in and out of their business. This will include thorough and accurate preparation, tracking and sending of invoices. We will also take on the task of sending reminder emails to any debtors that haven’t yet paid, and promise to make as many follow up calls as are needed to get every dollar your business is owed. We will also put together regular reports, ensuring that you always know where your finances stand.

Calculating gst and preparing any relevant invoices

Tracking invoices to your debtors electronically

Sending invoices to your debtors electronically

Following up on any overdue payments and sending reminder phone-calls and emails if required

Regular and accurate reporting of accounts receivables

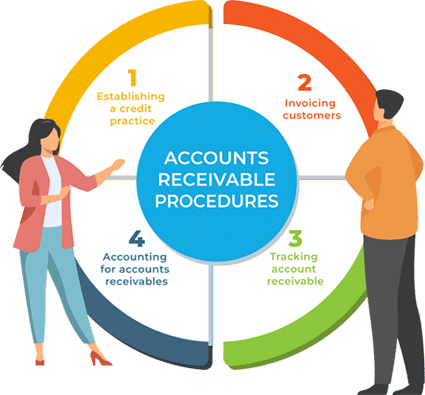

Accounts Receivable Procedures

While this can vary slightly depending on the scale of the firm, in a typical accounts receivable process, there are four main stages:

Step 1Establishing a credit practice

Initially, your company will need to manufacture a credit application process. This process will allow you to decide whether an applicant is credit-worthy and trustworthy enough to be offered your company’s goods on credit. You’ll also need to determine terms and conditions for any sales, ensuring that this complies with any credit laws. For example, credit practices need full disclosure. You may want to vary your credit period depending on the size of your firm, as larger ones can sometimes afford to allow their customer a longer period of time to pay their invoices.

Step 2Invoicing customers

Initially, your company will need to manufacture a credit application process. This process will allow you to decide whether an applicant is credit-worthy and trustworthy enough to be offered your company’s goods on credit. You’ll also need to determine terms and conditions for any sales, ensuring that this complies with any credit laws. For example, credit practices need full disclosure. You may want to vary your credit period depending on the size of your firm, as larger ones can sometimes afford to allow their customer a longer period of time to pay their invoices.

Step 3Tracking account receivable

Initially, your company will need to manufacture a credit application process. This process will allow you to decide whether an applicant is credit-worthy and trustworthy enough to be offered your company’s goods on credit. You’ll also need to determine terms and conditions for any sales, ensuring that this complies with any credit laws. For example, credit practices need full disclosure. You may want to vary your credit period depending on the size of your firm, as larger ones can sometimes afford to allow their customer a longer period of time to pay their invoices.

Step 4Accounting for accounts receivables

Initially, your company will need to manufacture a credit application process. This process will allow you to decide whether an applicant is credit-worthy and trustworthy enough to be offered your company’s goods on credit. You’ll also need to determine terms and conditions for any sales, ensuring that this complies with any credit laws. For example, credit practices need full disclosure. You may want to vary your credit period depending on the size of your firm, as larger ones can sometimes afford to allow their customer a longer period of time to pay their invoices.

Automation and the accounts receivable process

As technology increases, businesses are becoming more efficient. Many companies offering accounts receivable services are looking to implement an automated solution in order to reduce bad debt and increase the efficiency of the service. This includes procurement, invoice processing, invoice approval, payments, vendor management and system upgrades, as well as reporting.

In general, automation offers a modernised and electronic version of the accounts receivable process, allowing quicker and easier methods such as e-invoicing.

This is becoming the default mechanism for invoicing due to it being less time-consuming and more accurate, as the risk of human error is eliminated.

Tips for Managing Your Debtors

For a small business in particular, it can be easy to forget to manage your debtors effectively. However, a good method of debtor management is crucial for keeping track of your cash flows and making sure your business is running to the optimum standards. Whether you use our services or attempt to manage your debtors yourself, some simple steps can be taken to ensure this is done effectively:

Having Terms Of Trade

You may be currently opting to supply your services more informally, especially if you are running a small business. However, you are much more likely to experience disputes and come across issues if you do not have clear terms of trade established from the start of your business. You can also reduce the number of bad debts you will receive.

Credit Policy In Place

Ensuring that you have completed a thorough credit check before offering any new customers credit will minimise problems with your debtor in the future. Having your terms written down will ensure that clients know the acceptance of terms, and are more likely to follow the credit policies.

Ensuring Invoices And Quotes Are Always Correct

Customers are more likely to conduct payments on time if your documentation is always done accurately. If statements clearly state the due date, the amount owed, your bank details and the billing address, you won’t have to waste time amending invoices if your customer claims it is inaccurate. To minimise the risk of late payments even further, you can detail any collection charges that may accumulate if their accounts end up being overdue.

Making Sure Systems Are Up To Date

At Geekbooks, we promote well-maintained information, as we believe this is the secret to effective debtor management. As technology advances, more software solutions are becoming cloud-based. Our software and systems assist with credit management by relieving some of the administration, which tends to be very time-consuming. The key to debtor management is monitoring clients closely and always being aware of when payments are due, or if they have any outstanding.

More Tips

Not Overextending On Credit

It would be unreasonable to have the same credit limit for each of your customers, as this should vary on their individual financial situation. It’s also a good idea to review each of your client’s credit limits in case their situation changes, it which case you may want to consider decreasing or increasing. This might be evident in how their buying habits change, or whether their debt increases.

Credit Limit

It’s important to carefully consider whether increasing a customer’s credit limit is a good idea. They may request this if their business is looking to be expanding quickly, however, this may put pressure on their ability to pay you on time if their priorities lie elsewhere. Saying this, a growing business may help your company’s sales, so the advantages must be weighed up. Our friendly and professional team is always happy to help with queries such as this.

Account Management Strategy

Having an account management strategy means that when it comes to accounts receivable and debtor management, the process will appear much simpler. It will also allow you to maintain a long-term relationship with your clients, due to knowing the specific approaches that will work for individual customers.

Cultivating

Investing time and effort in customers is the key to maintaining a relationship. Your clients need to want to work with you. They should never feel as though you are simply interested in what you are gaining from their account, instead of also thinking about what you can contribute. When taking on a new customer, it’s often a good idea to be as available to them as possible, offering additional services so they know that you are dedicated to their business, as well as their payments.

Consulting

You customers should never see you as a salesperson but as a consultant. They should trust you to offer genuine advice in terms of their services and products. You should also approach them as much as they approach you, keeping them informed of any progress or advancements.

Caring

If your clients think you care about their individual business, they are more likely to be loyal to you. And consequently, they’re more likely to get your payments to you on time. If someone is purchasing your products or services, they are expecting you to help them in some way. If this is clear to the customer, they’ll want to help you back. If you are simply a faceless figure taking their money, their priorities are likely to be elsewhere.

Your Questions Answered

Accounts Receivable (AR) are the payments or proceeds received by a company from customers who have purchased services or goods on credit. The credit period is usually short, ranging from a few days to months or even a year in some cases.

Accounts receivable refers to an organisation’s unpaid bills, or the money clients owe the organisation. The term refers to accounts that a firm is entitled to receive after delivering a product or service. Accounts receivable, often known as receivables, indicate a line of credit given by a business and typically include terms requiring payment in the short term.

Accounts receivable are recorded as assets on balance sheets since the client has a legal duty to pay the debt. They are classified as liquid assets since they may be used as collateral to obtain a loan to assist in meeting short-term commitments. Receivables are a form of working capital in a business.

Debt management refers to the measures taken to minimise or eliminate debt. It entails a number of stages and actions, including negotiating with creditors for a lower interest rate, developing a budget, and giving discounts to increase sales. In essence, it refers to any action taken to minimise, reorganise, or do away with financial liabilities.

Debt is an unavoidable aspect of running a business. A line of credit, business loan, or credit card for business can assist your firm in hiring new staff, purchasing merchandise, purchasing equipment, and financing expansion. However, too much debt might obstruct your company’s goals and become an unsustainable burden. As a result, debt management is critical to maintaining your credit rating and business operations.

Accounts receivable are calculated in the following steps;

- Calculate all charges

Add up the amounts that customers owe for services and products delivered. Essentially, the purchases were made on credit, and the client owes your business on a short-term basis. Every business has a timeframe for calculating their accounts receivable, such as monthly or quarterly.

- Find the average

This is achieved by calculating the total accounts receivable amount divided by the number of line items.

- Calculate net credit sales

It is the first step in calculating the accounts receivable turnover ratio. Subtract the sales allowances and sales returns from sales made on credit.

- Divide net credit sales by average accounts receivable

This is how your accounts receivable turnover ratio is calculated. This percentage offers you a better understanding of how effective you are at collecting money due to the company.

In general, a greater number is preferable. It indicates that your consumers pay on time and that your business is effective at collecting debt. A higher figure may also indicate improved cash flow, a stronger balance sheet or income statement, balanced asset turnover, and even more creditworthiness for your organisation.

A high percentage may also indicate that a corporation is cautious about granting credit to its consumers. Conservative credit practices can help businesses avoid offering credit to clients who may not be able to pay on time.

On the other hand, having an overly cautious lending policy may turn off potential clients. These consumers may then conduct business with competitors who can provide and extend the credit they require. If a firm loses customers or has poor growth, it may be better off easing its credit policy to boost sales, even if it results in a lower accounts receivable turnover ratio.

A debt management plan (or DMP) is a technique to get out of debt and rehabilitate your credit while making affordable monthly payments. They may be quite advantageous for businesses that are in debt and need assistance getting a handle on it. Participating in a debt management plan also teaches companies how to properly manage their finances so that they don’t go into debt again in the future.

Multiple unsecured debts are typically wrapped into a single monthly payment under a standard debt management plan.

If you collaborate with a debt management company, the firm may negotiate with creditors on your behalf in order to create a sustainable payment schedule. This plan may include cheaper monthly payments, lower interest rates, or the elimination of certain penalties. In exchange, you may be required to commit to a structured payment schedule that usually takes several years to complete.

If you determine that a debt management plan is the best option for you, your credit counsellor can assist you with enrolling. He or she will negotiate interest rates with your creditors and create a payment schedule, which you will examine and accept before the plan begins. After essential operation expenditures such as rent, utility bills, mortgage, secured loans, and employee expenses have been met, the leftover funds can be split among creditors.

You will then make a monthly payment to your credit counselling company. In turn, the organisation will transfer the funds to your creditors in accordance with the payment plan you agreed upon.

A debt management strategy will cost you very little money. You should only have to pay a small one-time set-up charge and minimal monthly maintenance charges after counselling sessions.

Testimonials

Geekbooks has helped

Thanks to the team at Geekbooks, I can now finally focus my attention on working on my business, not in my business. From managing invoices to chasing up outstanding payments, Geekbooks has helped me so much. They are friendly, easy to work with and just make it happen. Thanks guys.

Gunjan

True Professionals

I recommend Geekbooks as true professionals whom have the experience to handle any situation from the simplest bookkeeping to preparing books for accountants use or auditing. Since engaging with Geekbooks they have helped my business grow and taken the pressure off me so I have more time to run my business as I should be. I have the utmost confidence in referring clients to Geekbooks.

Gerard

Managing the Books

We have been using Geekbooks bookkeeping services since the end of 2017. They have really taken the stress out of managing the books, as no request is too small or too big. They are quick, efficient and professional and my business would not be in the position it is in now if I didn’t have them backing me every single step of the way. Weekly payroll is now a stress free day for me as all I need to do is send a report of hours worked for employees and they calculate the rest. Never been so stress and hassle free in my life since when I signed up with Geekbooks.

Prakash Automotive Services