BAS (Business Activity Statement) Services

Bookkeeping Professionals since 2001. Give us a call & join our family of happy clients.

Be assured with our 30 day money back guarantee.

We are ready to chat wITH YOU!

Learn More About How We Can Help With BAS

What is BAS?

A BAS (business activity statement) is necessary for any business that is registered for GST (goods and services tax.) You are legally required to prepare BAS (business activity paperwork) for the ATO (Australian tax office.) It’s in your best interest to ensure this is done accurately and on time, as you will be charged for any delays and/or mistakes. The calculations that you report in your BAS must also be up-to-date.

Your BAS is designed to help you pay for, and report:

- PAYG (pay as you go) instalments.

- PAYG withholding tax.

- Goods and services tax.

- Any other taxes

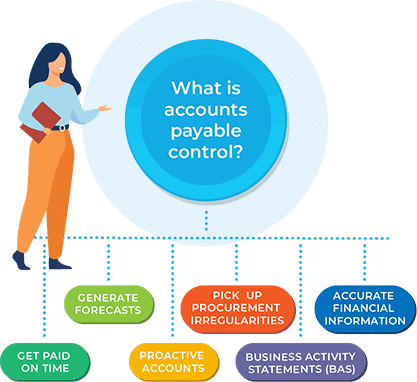

What is a BAS service?

Geekbooks are one of Australia’s leading BAS services. We specialise in accurate and expert BAS preparation for any small businesses throughout Australia. Our services include:

Preparation

Gathering your documentation, reports, and any other relevant details needed to prepare an accurate BAS for your business.

Calculations

Calculating an accurate figure for your company’s full tax return, including PAYG, GST and any other relevant taxes that must be considered.

Formatting

Carefully formatting your BAS and ensuring it gets submitted before the deadline to avoid any subsequent costs.

Liaising

Liaising with the ATO on behalf of your company if needed.

When to Register for GST

Goods and service tax can be registered for online, or through Geekbooks, as your registered BAS agent. This can be done when your business is first registered, or at a later date. It’s important to check regularly whether your business has reached the threshold for GST if it has not previously done so. GST needs to be registered for when:

You’re looking to claim fuel tax credits.

If you expect a new business to reach the threshold within its first year.

You have a non-profit organisation with a gst turnover of at least $150,000.

If your business involves limousine or taxi travel. This is relevant regardless of your gst turnover figure.

Your gst turnover is $75,000 or more. This can be worked out by calculating your gross income and taking away your gst figure.

You don’t meet any of the above criteria but would like to opt for registering for gst regardless.

BAS Agents - Why Hire a BAS Agent?

As a registered BAS agent, Geekbooks can assist in BAS preparation, submission, and lodging. But why use our services as opposed to doing it yourself? Here are some reasons:

Some companies may choose to hire an employee specifically to take care of accountancy requirements such as GST. However, this may prove to be a waste of resources when you have the option to simply pay for our expert services. Our sole purpose is GST preparation and lodging, meaning we don’t require the same as an employee and can work more efficiently with only one task on our minds.

Experience

With years of experience completing BAS, you can sleep easy knowing that your statement is in good hands. As a BAS agent, we have optimum knowledge and expertise of the field, meaning we never make mistakes. Our attention to detail is unmatched, and our services are the best in the area.

Save Time And Money

We guarantee that with our focus being on this one issue, your GST will be completed much quicker than it would by someone in your workforce with a multitude of other financial duties. Allow your time and money to be spent elsewhere.

Security

By supplying a BAS service, we are required to be registered by the Tax Practitioners Board, meaning you can share your information with us with the assurance that it is completely safe and secure.

Ease

GST can be a confusing and stressful requirement. By investing in our services, we can relieve some of this pressure by taking it upon ourselves. Our service is simple and personalised, but can be done by us with ease. Allow us to take on your stress and do the job that we are trained to do.

Experience

With years of experience completing BAS, you can sleep easy knowing that your statement is in good hands. As a BAS agent, we have optimum knowledge and expertise of the field, meaning we never make mistakes. Our attention to detail is unmatched, and our services are the best in the area.

Save Time And Money

We guarantee that with our focus being on this one issue, your GST will be completed much quicker than it would by someone in your workforce with a multitude of other financial duties. Allow your time and money to be spent elsewhere.

Security

By supplying a BAS service, we are required to be registered by the Tax Practitioners Board, meaning you can share your information with us with the assurance that it is completely safe and secure.

Ease

GST can be a confusing and stressful requirement. By investing in our services, we can relieve some of this pressure by taking it upon ourselves. Our service is simple and personalised, but can be done by us with ease. Allow us to take on your stress and do the job that we are trained to do.

Some common industries that usually have to register for GST include:

Advertising

Aviation and Aerospace

Construction

Charities and Non-profit Organisations

Finance

Automotive

Real-Estate

Travel

Retail

How to Find a Registered BAS Agent?

It’s important to remember that after October 31st 2020, if you don’t use a registered agent, you’ll risk being fined for breaching tax lodgement regulations.

Some things to consider when choosing a BAS agent are:

- Their qualifications

- Their licenses

- How long the practice has been functioning and how long the agent has been working there

- The kinds of services they offer

- How much access you will have to data

- How long the work will take to be completed

Avoid the risk of a bad lodgement

Submitted On Time

Our BAS preparation services ensure that your BAS is submitted on time, as well as being as accurate as possible. As you will be aware, if you are a business who is legally required to submit a BAS, and fail to do so, you will incur a financial penalty. Simliarly, if a BAS is submitted late, a penalty may also be levied.

Flexible And Pro-active

When you use GeekBooks' BAS preparation services, we make sure that your BAS is submitted in time for the relevant deadline. Our flexible, pro-active approach means that even if you've left it to the very last minute to submit a BAS, we can still usually get it in on time.

Meticulous

We make sure your BAS is prepared meticulously and correctly. It's important to pay the right amount of tax when required: accurate predictions and skilled tax management can optimise the chances that you won't pay more than you need to.

Have you submitted a bad lodgement in the past? Some businesses find that the amount of tax they've paid as a result of a bad lodgement is very different from the correct figure. When you use our expert bookkeepers for your BAS preparation services, we can rectify the problems caused by previous, poor-quality BAS submissions.

Up-to-date knowledge of BAS reporting changes

Why not use us for your next BAS lodgement and see the positive difference we can make to the process? Our prices start at just $25/hour - far less than the penalty ATO impose for a late or missing BAS. Remember we offer a 30-day money-back guarantee - if you're not satisfied with our BAS preparation services, we'll refund your fee!

Why Choose GeekBooks?

We offer a 30-day money-back guarantee. You can chat with our team with the reassurance that if you decide our services aren’t for you, you won’t be at a loss.

Geekbooks has a comprehensive team of experts in the field, who pride themselves on their accuracy and attention to detail. By leaving your GST in our hands, you can be assured that you will receive no unnecessary fines due to late submission or careless mistakes. We are an established business with the capacity and time to spend as much time is needed on an individual’s GST. Customer service is at the core of our business, and we intend to make the process of submitting a BAS easy and stress-free.

Whatever your specific needs, we can assist. If you wish, you can take a complete backseat, and allow us to submit your BAS to the ATO on your company’s behalf. In this case, we can help with preparing BAS and calculating your GST and any other tax paperwork that may be required. We guarantee that our team is completely compliant, and you won’t regret leaving your GST in our capable hands. Our staff and resources are second to none, and can expertly deal with our customer’s requirements.

If you prefer to have slightly more input into the submission of your GST, we have a highly reviewed package of services that will simply allow us to assist in the preparation and submission process, from as low as $25 per hour. These packages will involve the composition of any relevant details, and the printing of reports, allowing your business’ documentation to be processed. With our help, you can reduce the time and stress spent on your GST, meaning it can be better spent elsewhere.

Geekbooks has a comprehensive team of experts in the field, who pride themselves on their accuracy and attention to detail. By leaving your GST in our hands, you can be assured that you will receive no unnecessary fines due to late submission or careless mistakes. We are an established business with the capacity and time to spend as much time is needed on an individual’s GST. Customer service is at the core of our business, and we intend to make the process of submitting a BAS easy and stress-free.

Whatever your specific needs, we can assist. If you wish, you can take a complete backseat, and allow us to submit your BAS to the ATO on your company’s behalf. In this case, we can help with preparing BAS and calculating your GST and any other tax paperwork that may be required. We guarantee that our team is completely compliant, and you won’t regret leaving your GST in our capable hands. Our staff and resources are second to none, and can expertly deal with our customer’s requirements.

If you prefer to have slightly more input into the submission of your GST, we have a highly reviewed package of services that will simply allow us to assist in the preparation and submission process, from as low as $25 per hour. These packages will involve the composition of any relevant details, and the printing of reports, allowing your business’ documentation to be processed. With our help, you can reduce the time and stress spent on your GST, meaning it can be better spent elsewhere.

How to Fill Out a BAS Statement?

There are three main steps to filling out a BAS statement, all of which Geekbooks can help with:

Organising Financial Records

While we can assist in gathering any relevant documentation needed to put together your BAS, it’s easier if you have already attempted to maintain correct and up to date business records. It might sound time-consuming, but it’s best to record all business-related purchases or sales on a daily basis. This way, you’ll ensure nothing gets missed.

You’ll find that many Australian banks can provide GST bank accounts with no, or at least limited, fees. If you use this to set some money aside in a separate GST account, it’ll be easier to pay taxes when the time comes.

Completing The Statement

When we complete your GST statement, we are essentially providing any information concerning business-related sales. If you imagine a spreadsheet, we’ll report your total sales in the first column, export sales in the second, and GST-free sales in the third and final one.

Your total sales will include everything except dividends or donations, while GST-free sales will include any sales of basic beverages and foods. We’ll then use these figures to calculate the sales for the full reporting method and report any capital and non-capital purchases. After reporting the total amount of GST that your business is liable for in the summary section, your statement will be finalised.

Bas Lodgement

Your BAS and payment now need to be submitted through ATO online services. Even if you opted to complete the statement yourself, as a registered BAS agent, we can help with lodging BAS online. If you are registered with the ATO business portal, you will have access to your BAS statement form through this system, even after it has been submitted by us.

Don’t forget, you might not have anything to report for each period. However, ATO still requires you to lodge a BAS, in which case, you can use their automated phone line.

How to Fill Out a BAS Statement?

Adjust amounts

At Geekbooks, we can help fix any mistakes you’ve made having attempted to prepare or submit your BAS. There are two versions of this: mistakes, and adjustments. A mistake means that an amount was incorrect at the time you lodged your BAS. And adjustment means that the amount was correct when you completed the lodgement, but something has changed afterwards.

Editing BAS

We can fix a mistake by either editing the original BAS or waiting until your next one is due and fixing the issue at this point. This will normally depend on whether your error was concerning credit or a debit. If the mistake is relating to GST or fuel tax credit, we will most likely be able to correct it in your next BAS. If this is not the case, we can assist you in lodging a revision.

Advice

We can also provide advice on when it may be necessary to make an adjustment, which would need to be reported for your current reporting period using the activity statement. Adjustments may need to be made if goods are returned, meaning the sale is cancelled, or if the price of a purchase changes after you have submitted your BAS.

Keeping on Top of Your Business

Being required to submit a BAS is a good opportunity to keep on top of your business records.

Tips for record keeping:

- Make sure to keep an up to date record of all business costs including wages, expenses, sales and fees.

- Keep logbooks and stocktake records to provide evidence of any motor vehicle claims.

- Make sure sales and bank statements are reconciled.

- Keep GST and tax invoices for at least five years.

When not to claim GST credits:

- Do not claim for any purchases in which GST is not included in the price, for example, stamp duty, bank fees, basic beverages and foods.

- Imported goods. This is only relevant if you are the importer, and the goods are being used for your business.

- Any purchases made within a GST group. However, purchases between GST branches can be claimed.

Claiming GST Credits

- You can only claim GST credits for business-related purchases.

- Make sure to keep an up to date record of all business costs including wages, expenses, sales and fees.

- Keep logbooks and stocktake records to provide evidence of any motor vehicle claims.

- Make sure sales and bank statements are reconciled.

- Keep GST and tax invoices for at least five years.

- If your purchase has a discounted price but this doesn’t appear on the invoice, you must still claim GST for the discounted price.

- Make sure to keep an up to date record of all business costs including wages, expenses, sales and fees.

- Keep logbooks and stocktake records to provide evidence of any motor vehicle claims.

- Make sure sales and bank statements are reconciled.

- Keep GST and tax invoices for at least five years.

- Make sure to keep an up to date record of all business costs including wages, expenses, sales and fees.

- Keep logbooks and stocktake records to provide evidence of any motor vehicle claims.

- Make sure sales and bank statements are reconciled.

- Make sure sales and bank statements are reconciled.

- Keep GST and tax invoices for at least five years.

- If you use cash to account for GST, claim for the credits up-front for products under hire purchase agreements.

- Remember to use the Australian dollar for GST credits even when claiming in a foreign currency

- You can sometimes be required to repay GST credits if your business changes.

Your Questions Answered

The phrase ‘BAS agent’ is a legally protected title that refers to an individual or business that fulfils the Tax Practitioners Board’s registration standards (TPB). BAS services are provided by registered agents in accordance with the Tax Agent Services Act 2009. (TASA).

A high level of professionalism, certification, experience, and competence is required to work as a BAS agent. To stay current in the ever-changing corporate and regulatory settings, BAS agents must engage in frequent professional education.

BAS agents process, calculate and advise business owners on the exact amounts of liabilities, as well as complete numerous statutory reporting procedures. Registered agents can develop and install business systems, accounting software, and payroll software to meet the demands of the firm and give reliable financial information. They also offer business owners advice on payroll, BAS provisions, relevant laws and compliance obligations.

The Business Activity Statement (BAS) is a form used to record a company’s taxable activities to the Australian Taxation Office. It does not inform you of your own tax liability but rather informs the ATO of the amount of tax you have collected from others.

You can file your BAS annually, quarterly, or every month. If you don’t have a separate bank account for your GST and other payments, you should opt to make regular payments. The ATO will recommend a period depending on how much they believe you will withhold each month. However, you can always opt for a shorter interval. If you hire a professional to do your books, you should pick a longer interval because each lodgement would incur expenses.

In any case, you should constantly be informed of the amount you’ll be required to pay the ATO on your next BAS. The more often you utilise the funds in your assets, the more difficult it will be to meet your responsibilities at BAS time.

With respect to a variety of BAS services, a BAS Agent can advise a client, offer various levels of information, and/or represent a customer to the Australian Taxation Office. Some examples include:

- GST.

- Payroll processing, including tax withholding and reporting obligations.

- Other PAYG withholding amounts include no ABN, dividends and interest.

- PAYG Instalments are used to pay income tax.

- Wine tax, luxury car tax and fuel tax.

- Payments for Fringe Benefits Tax (FBT).

- Annual Reporting System for Taxable Payments

- The Superannuation Guarantee system.

BAS Agents may also help with the design, set-up, and implementation of company compliance systems, as well as advise on how various areas of legislation influence them. They also evaluate client activities to assure compliance.

Before seeking registration, qualified bookkeepers must earn at least 1,000 hours of relevant experience under the supervision of a registered agent. BAS agents often operate as independent contractors for their own customers. However, they may also be employed or contracted by bookkeeping or accounting businesses.

Business owners can perform their own BAS if they are set up by a professional who will give assistance and set-up processes, as well as monitor transactions. If you have a controlling mechanism in place that prevents major errors from happening, you don’t normally require a highly skilled specialist to handle data input.

Before you decide whether or not you want to do your BAS by yourself, you should consider if you want to perform all of the business’s bookkeeping independently. This choice will be based on how effectively you keep your books and how much time you have available to do so. Accounting software can help with bookkeeping, but it is only as good as the data you input into it! In general, if you just have one business bank account through which all of your business transactions are processed, you may be able to perform your own bookkeeping. Just be certain that you:

- Enter all money coming in from sales with GST attached.

- Check for any money moving out of a GST-allocated transaction.

If you can manage this, GST reporting should be a straightforward process for you. If your accounts do not fall into these categories, consult your accountant. You may also hire professional help at an affordable rate if you are experiencing difficulties or if it is your first time undertaking the process.

Testimonials

Geekbooks has helped

Thanks to the team at Geekbooks, I can now finally focus my attention on working on my business, not in my business. From managing invoices to chasing up outstanding payments, Geekbooks has helped me so much. They are friendly, easy to work with and just make it happen. Thanks guys.

Gunjan

True Professionals

I recommend Geekbooks as true professionals whom have the experience to handle any situation from the simplest bookkeeping to preparing books for accountants use or auditing. Since engaging with Geekbooks they have helped my business grow and taken the pressure off me so I have more time to run my business as I should be. I have the utmost confidence in referring clients to Geekbooks.

Gerard

Managing the Books

We have been using Geekbooks bookkeeping services since the end of 2017. They have really taken the stress out of managing the books, as no request is too small or too big. They are quick, efficient and professional and my business would not be in the position it is in now if I didn’t have them backing me every single step of the way. Weekly payroll is now a stress free day for me as all I need to do is send a report of hours worked for employees and they calculate the rest. Never been so stress and hassle free in my life since when I signed up with Geekbooks.

Prakash Automotive Services