Business Activity Statements (BAS) are a source of anxiety for many modern business owners.

That stress only gets worse if you have not been keeping accurate records of your business finances and putting money aside to pay for it when it is due.

Any business that is registered for Goods and Services Tax (GST) is required to lodge a BAS.

They are issued by the Australian Tax Office (ATO) to facilitate the reporting and payment of tax liabilities by businesses in a single time and place.

If this is causing any anxiety, it can be helpful to get a fuller understanding of what Business Activity Statements are.

You need to be fully aware of if and when you need to lodge your statement and when the payment will be due.

In this article, we will look at everything you need to know about Business Activity Statements so that you can feel confident when submitting yours.

Learn what payments are included, how often you must lodge your BAS and what the penalty is for filing late.

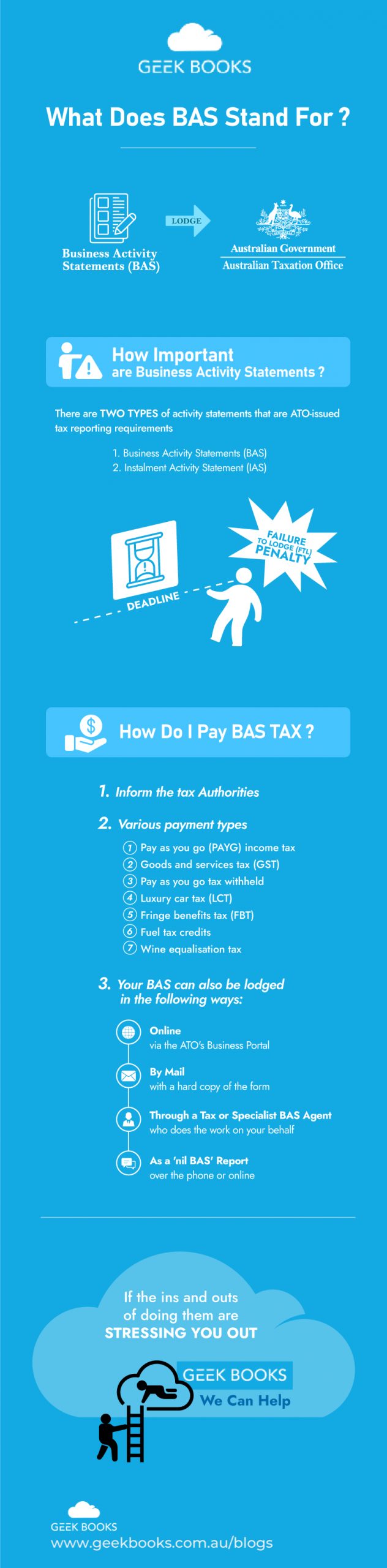

How Important are Business Activity Statements

Activity statements are ATO-issued tax reporting requirements, and there are two types.

BAS is one, and it is the most comprehensive, and the other is the Instalment Activity Statement (IAS).

The latter option is certainly simpler and many business owners prefer to follow this type for their September activity statement if they qualify for it.

However, we are focused on BAS in this article.

A BAS is an official government form that all businesses are required to lodge.

It summarises all the business taxes paid or payable during a given period of time, and it is submitted to the Australian Tax Office.

They are typically submitted on a monthly, quarterly or annual schedule.

Your BAS obligations are a legal requirement and as such you must not ignore them.

Failure to submit your BAS by the BAS due dates may result in a failure to lodge (FTL) penalty.

These fines tend to go up if you are frequently late to lodge your BAS.

As it stands, you can be penalised $110 for every 28 days (or part thereof) that your business misses the deadline.

This goes up to a maximum of $550.

A business can use a tax agent for the BAS requirements, but it is still that business’s responsibility to meet the deadlines.

Therefore, if you have reason to believe you will not be able to submit your BAS on time, you must request an extension or arrange a payment plan as early as possible.

There is a facility for businesses to make voluntary payments early to offset their future BAS liability.

How Do I Pay BAS Tax?

In a BAS, you essentially inform the tax authorities of how much money you have collected and how much you have paid out.

Various payment types are included, such as:

- Pay as you go (PAYG) income tax – the incremental amounts you pay towards your annual tax liability.

- Goods and services tax (GST) the value-added tax of 10% placed on most goods and services (there are exemptions).

- Pay as you go tax withheld – the amounts that an employer withholds from the wages of employees to cover their income tax obligations.

- Luxury car tax (LCT) – a tax on the supplying and importing of luxury cars that exceed a certain value threshold.

- Fringe benefits tax (FBT) – a tax employers pay on providing certain benefits for their employees, such as providing a company car or covering their gym membership.

- Fuel tax credits – the credit a business is provided for the fuel tax included in the price of fuel they use in machinery, heavy vehicles and plant equipment.

- Wine equalisation tax – only applicable to manufacturers, importers and wholesalers of wine, this tax is based on the wine’s value.

To prepare your BAS, you should ensure you have all the relevant data to hand and all your accounts are fully up to date.

You will need to have a printout of your BAS summary report from your accounting software, providing you with a rough idea of how much you will owe with your BAS.

At this point, ensure you have the funds to pay what you owe. Create a profit and loss statement and ensure everything is accurate.

Many accounting platforms have a function to submit your BAS from within the software.

As long as you have been organised and captured information regularly, you should be in a good position to submit your BAS with minimal hassle.

Your BAS can also be lodged in the following ways:

- Online via the ATO’s Business Portal. This is paperless and can be the most straightforward way to do it if you don’t use accounting software.

- By mail with a hard copy of the form. This was the only method before online submission became available, and it is still the preferred method for many business owners.

- Through a tax or specialist BAS agent who does the work on your behalf – this can be a great way to reduce stress and get peace of mind about accuracy.

- As a ‘nil BAS’ report over the phone or online – this is only possible if you have nothing to report for the period in question. You may be required to submit evidence of this.

The form itself is fairly simple.

As long as you have been diligent in your bookkeeping and maintaining up to date financial records, it should not be too difficult.

Summary

Business Activity Statements have a reputation among business owners as stress-inducing bureaucratic hardship.

This can be true if your business activities are very complex and you have not kept an accurate record of them.

But with diligence and the right tools to track all your money coming in and going out, BAS really doesn’t have to be difficult.

Business Activity Statements are actually a convenient way to keep up with a number of your business tax obligations in a single place.

If the ins and outs of doing them are stressing you out, Geekbooks can help.

We provide a specialist BAS Preparation Service that takes care of all the complicated work to give you peace of mind.

Let us remove all the guesswork so you can meet your obligations and keep focusing on running your business. Contact Geekbooks today and ask about how we can help with your BAS requirements.