End of quarter means it’s time to submit another Business Activity Statement for your business.

These are issued by the Australian Tax Office and are essentially a facility for you to report the money that has come in and gone out of your business to cover a range of tax liabilities.

Failure to submit your BAS before the deadline will result in a fine and you are legally obliged to lodge your statement and pay what you owe.

BAS time can be a source of stress for many business owners.

But if you have been diligent with your bookkeeping and have up to date, accurate data to work with, it is relatively straightforward.

Geekbooks offers specialist BAS Preparation Services to give you peace of mind about the whole process.

We have also compiled this handy BAS preparation checklist to help you prepare it yourself when the time comes.

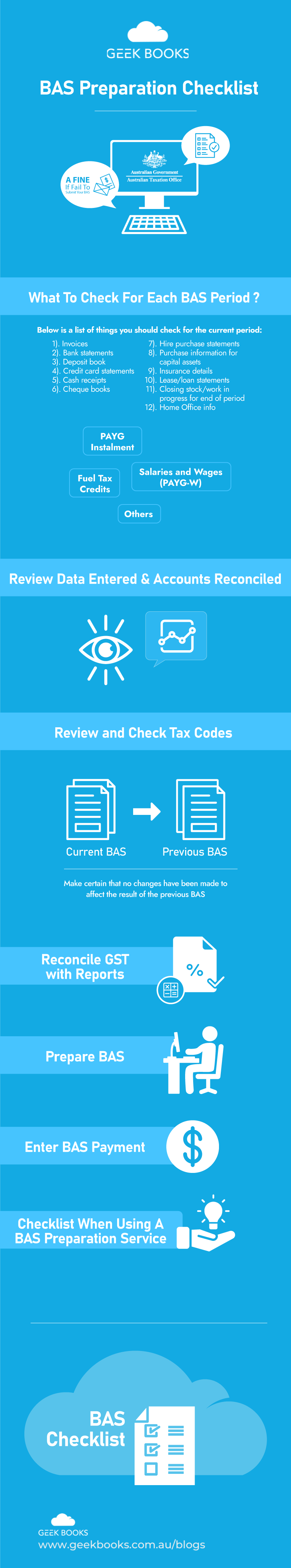

What To Check For Each BAS Period

It is important to be accurate and include all the relevant figures in your BAS.

Below is a list of things you should check for the current period.

With regards to your GST obligations:

- Invoices

- Bank statements

- Deposit book

- Credit card statements

- Cash receipts

- Cheque books

- Hire purchase statements

- Purchase information for capital assets

- Insurance details

- Lease/loan statements

- Closing stock/work in progress for end of the period

- Home Office info

For information relating to PAYG installment:

- Details of partnership or trust installment income where applicable

For information relating to salaries and wages (PAYG-W):

- The total sum of salaries and wages, including directors’ fees, commissions, non-cash benefits, eligible termination payments, etc.

- The total amount of tax withheld

- Amount withheld from investment distributions

- Amount withheld from creditors’ payments

For information relating to fuel tax credits:

- Total number of litres bought for the period (including receipts)

Other key information to check:

- Check if any vehicle purchases/sales meet the luxury car criteria

- Records of overseas purchases (including customs invoices)

- Insurance claims and refunds

- Government grants

- Directors/owners’ loans

All receipts and payments recorded should distinguish between those made by cash, credit card and cheque. You should also have information relating to:

- Any purchases of new capital assets

- Information relating to the sale of capital assets

- Any changes that may impact BAS reporting

Review Data Entered & Accounts Reconciled

Once you have collected all the data from the checklist above, it’s important to carry out the following tasks to ensure everything you submit in your BAS is accurate and up to date.

Review and Check Tax Codes

It’s essential to make certain that no changes have been made to affect the result of the previous BAS.

Any errors or inaccuracies relating to tax codes could delay the successful lodging of your BAS and may even result in a late filing.

Reconcile GST with Reports

Accounting is complex and requires accuracy and detail.

If your BAS were subject to an audit, any inconsistencies or inaccuracies would be discovered and this could cause problems for your business.

Avoid discrepancies by reconciling your GST report with other reports like income and P&L. You should also check it against balance sheet accounts and look for any issues.

If you discover a discrepancy, clear it up to ensure everything is accurate and no errors are present in your BAS.

Prepare BAS

- Run a GST detail report and ensure all tax code allocations are accurate.

- Print/download GST cash or accrual detail report for the relevant period.

- Run a GST summary report and review it before saving.

- If GST is deferred, check that liability is accurate.

- If FBT, fuel tax, and WET are relevant, fill in the amounts.

- Reconcile all accounts fully

- Lock the period to ensure the data cannot be changed>

- Print/save payroll summary for PAYG-W (if applicable)

- Print/save profit and loss accrual for PAYGI (if relevant)

- Prepare the BAS form and check balances

- Print the BAS transaction report

- Complete the BAS (keep a copy for your records)

Enter BAS Payment

The payment must be entered using the total values from your GST reports.

You must also allocate the rounding to the rounding account. If your BAS is Accrual, you should check that the remaining balances on the balance sheet are zero, or if it is cash then check the amounts on the receivable and payables summary of the tax report.

After this, you are ready to enter and complete the payment.

Remember:

- Review data entered and accounts reconciled ensuring everything is accurate and up to date.

- Review and check tax codes to ensure no discrepancies due to changes.

- Reconcile GST with reports so that all data that forms your BAS payment amount is confirmed.

Checklist when using a BAS Preparation Service

If you are doing your own bookkeeping, you must take the time to keep up-to-date records throughout the year via your accounting software.

When BAS time comes around, you must follow the checklist above to ensure everything is in order as you lodge your BAS and make your payment.

If you use a BAS preparation service like that offered by Geekbooks, all the calculations and reconciling are done on your behalf by a qualified, experienced professional accountant.

You simply need to provide the necessary information and supporting evidence, meaning:

Information relating to GST

The checklist in the first section of this guide includes all the documentation you need to check for GST.

The listed information will need to be provided to your accountant, so it is important to keep all these documents safe and secure in an organised way to minimise hassle at this stage.

Salaries and wages information

Your accountant will need all the information you have relating to the salaries and wages paid to employees.

Amounts withheld from employees for PAYG-W and any other related schemes are particularly important.

PAYG

Provide all pertinent details relating to your tax liability for PAYG.

Your accountant will advise on issues relating to partnership or trust installment income, and any other data that must be included.

Fuel tax

Be sure to report accurately with receipts and other supporting evidence to get the fuel tax credits you are owed.

This includes fuel used for vehicles, heavy plant machinery, and manufacturing machinery used for your business.

Once you have provided all the necessary information, your BAS Preparation service will carry out all the calculations, format the BAS appropriately and liaise with the ATO on your behalf as required.

They will also keep you updated and answer any questions you have throughout the process.

Summary

BAS can be complex and time-consuming, particularly for larger businesses, and it is a legal requirement to lodge your statement on time and pay what you owe.

The BAS checklist in this post will help you ensure you don’t miss anything if you are filing yourself, but the processes involved can still be challenging and require complete accuracy.

If you have concerns about doing BAS yourself, contact Geekbooks and ask about our BAS Preparation Service. We can take all the complexity off your hands so you can focus on running your business.