Good financial health and consistent insight into your money are essential for running any business, large or small.

Balance sheets are one of the best ways to get a handle on what your current finances look like during a particular period or on a specific date.

If you’re wondering ‘what is a balance sheet?’, we cover all you need to know to help you understand the ins and outs of this financial document, including why they are so important in the first place.

Read on now for all the details:

What is a balance sheet in accounting?

New to finances or previously had an accountant or finance team handling general statements?

Then you may be wondering what is on a balance sheet, what it does, and why it’s so integral to your business plans.

As the name suggests, a balance sheet gives a specific balance reflecting a business’s current financial position.

As one of the three most important financial statements your company creates, a balance sheet provides a clear snapshot of where your business is in terms of equity, assets, and liability.

In the simplest of terms, a balance sheet in accounting provides you with a final calculation of your net worth.

This is based on how much goes into the business and how much comes out.

Balance sheets give an accurate look at how balanced your business is in terms of your financial health.

If you’ve heard of the term ‘balancing the books’, balance sheets are the same concept.

The idea is to balance out your finances to account for all money that goes into and out of your business.

The balance sheet definition is in the name – literally.

Other financial statements

Your financial balance sheet is one of the ‘big three’ financial documents you’ll need to produce for your business.

Alongside ensuring you create balance sheets regularly, you’ll also need to make sure other critical financial statements are carried out regularly.

Often, all three of these documents are used for analysis, financial insight, and even application of loans and credit in tandem. In brief, these are the other statements you’ll need to keep up to date:

Income statements

Also referred to as a profit and loss statement, this document reflects a company’s income over a quarter, year, or month.

Expenses are deducted from the profit to figure out net income for the business during the specifically defined period.

Cash flow statements

Cash flow statements are an overview of the income flowing into the business and the outgoing cash.

This simple document can tell businesses at a glance if they have a problem with negative cash flow over time.

Why do businesses need to create regular balance sheets?

You may be wondering what makes balance sheets so important. What is on a balance sheet is a snapshot of the overall financial health of your business.

Although it is important for shareholders, financial services, and outside regulations, it’s also important for internal purposes. If you want to grow your business, improve your finances and ensure your company is healthy, having all the information you can get can make all the difference.

Balance sheets also aren’t isolated documents.

With months or years worth of up-to-date financial records in place, it’s far easier to see the bigger picture and spot trends in your finances.

The information found in balance sheets is vital for proper financial analysis of your company, whether done in-house or by an external financial service.

The clearer your finances, the more likely you are to spot issues and appeal to potential investors.

Balance sheets and ratios

Ratios are a way to provide investors and shareholders with a good idea of your company’s health.

The numbers formulated in your balance sheet can be used to create many different ratios.

This includes a debt-to-equity ratio that defines how much the company is financed through owned funds instead of credit or other forms of debt.

Quick ratio, or acid-test ratio, can also use your balance sheet calculations to identify the short-term health of a business.

While balance sheets are a valuable tool solo, they are essential for creating more complex or specific financial documents and insights.

As a fundamental foundation, your balance sheet is the first step to providing many other financial figures.

Creating a balance sheet

To understand your financial position, you’ll need to create a balance sheet.

While a relatively simple statement, you’ll need to have a few pieces of information ready.

These include your assets, your liabilities and the owner’s equity.

All this information is required to create the ‘balance’ between your incomings, outgoings and current equity. The formula for a balance sheet looks like this:

Assets – Liabilities = Owner’s Equity

This is where the balance comes in.

The concept of a financial balance sheet is that your assets, minus your liabilities, should equal the owner’s equity in the company.

Once you have all the details pulled together, the actual calculation you need to make for balance sheets is the easy part.

Here is a more detailed breakdown of all the information you’ll need to collate to figure out your final balance sheet calculation:

Assets

Assets are any cash or income that comes into your business and assets that aren’t so easily converted into money.

Or those that aren’t designed to be used as cash. While that may sound complicated, assets can easily be split into three distinctive categories: current assets, fixed assets, and intangible assets.

Current assets

Current assets are impermanent forms of income that your business will only retain for a short amount of time – often fewer than twelve months.

This could include cash in the bank, stock, owed money from debtors, short-term investments, and petty cash.

Fixed assets

Fixed assets refer to assets you will retain in your business.

These assets may also be known as non-current or capital assets and can include improvements to buildings, investments in equipment and vehicles, and the purchase of office equipment.

Fixed assets are often designed to benefit the business over time through growth, whereas current assets are about what you spend here and now.

Intangible assets

Unlike other assets, intangible assets can’t be touched or used in the same way as money.

However, they still hold inherent value when it comes to calculating your overall assets.

Owned patents and trademarks, intellectual property and even customer lists and goodwill from a recently purchased company are all examples.

Intangible assets are often difficult to calculate without experience, so we recommended seeking professional help where possible.

Once you’ve listed all your assets based on their individual categories, you can then add everything together to reach your final figure for all fixed, current, and intangible assets.

Liabilities

Liabilities on your balance sheet are a list of all money your company owes.

That could be bills you need to pay to suppliers, interest on loans, monthly rental costs, and even salaries, utilities and other business running costs.

Everything that costs your business money is considered and liability and should be listed accurately. Liabilities fall into two categories: short-term and current and long-term.

Short-term and current liabilities

Short-term liabilities are generally debts or forms of credit that you’ll expect to pay off in the next 12 months.

These liabilities may include overdrafts, short-term loans, and trade creditors. In addition, anything you owe that has a fixed payment date within the next year should be listed under short-term liabilities.

Current liabilities should also include accounts payable, wages, interest, and dividends.

Long-term liabilities

Long-term liabilities don’t require full payment within a set year of balance sheet creation. That could be long-term loans, leases, secured bills and director’s loans to the business.

Much like your assets, you’ll want to list your liabilities out intentionally on your balance sheet. That means short-term or current liabilities go first, followed by long-term liabilities further down the list. Then, once everything is written down and double-checked, you can add all your liabilities together to achieve your total figure.

Owner’s equity

Once you have the final totals for both assets and liabilities, you can then go ahead and calculate your owner’s equity based on these figures.

All you need to do then is subtract the total assets from the total liabilities to achieve your final number.

This should be listed below all calculations for assets and liabilities in most cases. Owner’s equity is also often referred to as either shareholder’s equity or net assets, depending on the size of the business.

In essence, your owner’s equity is what is leftover in your business should you become liquidated and need to cover all your assets.

So if you’re in negative numbers for your owner’s equity, or the figure looks particularly low, that’s a sign you may need to do more to improve the profitability of your business overall or potentially reduce liabilities.

Depreciation

When you’re creating your balance sheet, one factor to consider with fixed assets is the depreciation of value.

Under Australian tax law, you need to spread the cost of depreciating assets over the time they are used. The Australian Government has a calculator available online specifically to figure out the depreciation of assets for your balance sheet and other documents.

Balance sheet example

The best way to understand what a balance sheet looks like is to look at real-world examples. Here’s an example we’ve created specifically to illustrate what your balance sheet could look like for a small business:

Generic Company Co

Balance Sheet

1st January 2021

Assets

Current assets

Cash: $5,000

Short-term investments: $500

Petty cash: $100

Total: $5,600

Fixed assets

Equipment: $1,000

Vehicles: $1,000

(less depreciation) ($300)

Total: $1,700

Intangible assets

N/A

Total assets: $7,300

Liabilities

Current liabilities

Accounts payable: $1,000

Short-term loans: $300

Total: $1,300

Long-term liabilities

Long-term debt: $1,000

Total: $1,000

Total liability: $2,300

Net assets: $5000

(assets minus liability)

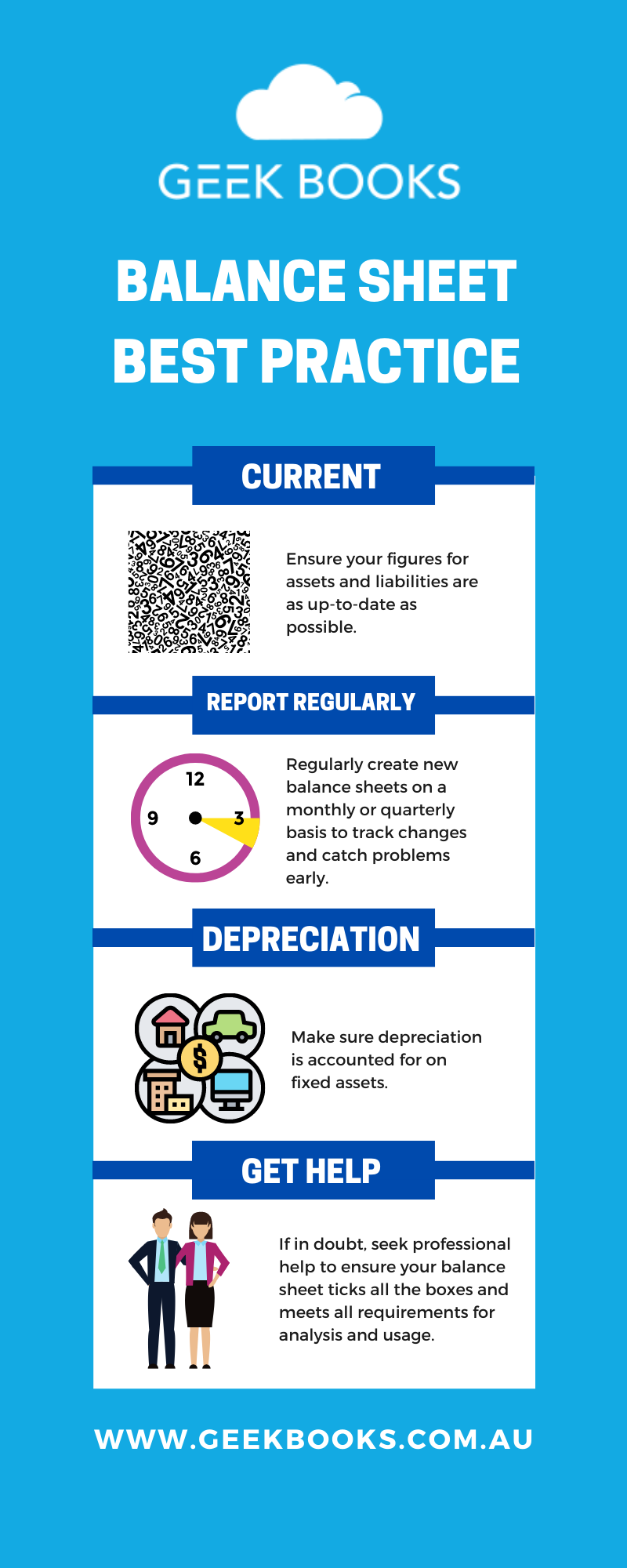

Balance sheet best practices

How do you make sure your balance sheets are of the best possible quality?

Following best practices is the ideal way to ensure your financial statements are in the best possible condition for taxes, investors, and anyone else that requires exact figures.

Here’s how to ensure your balance sheet is in the best shape for use:

• Ensure your figures for assets and liabilities are as up to date as possible before you start.

• Regularly create new balance sheets on a monthly or quarterly basis to track changes and catch problems early.

• Make sure depreciation is accounted for on fixed assets.

• If in doubt, seek professional help to ensure your balance sheet ticks all the boxes and meets all requirements for analysis and usage.

Need help creating balance sheets for your business?

Still stuck on balance sheets? No problem.

Our team at GeekBooks has extensive experience in creating and analysing financial statements.

Get in touch today to find out how you can outsource your balance sheet creation to our expert team.