As a business owner in Australia, understanding your tax obligations and ensuring compliance can be complex and time-consuming.

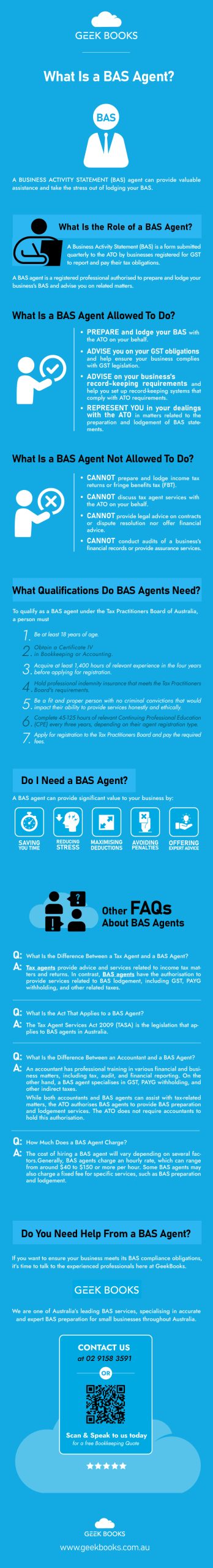

A Business Activity Statement (BAS) agent can provide valuable assistance and take the stress out of lodging your BAS.

A BAS agent is a registered professional who can help you prepare and lodge your BAS with the Australian Taxation Office (ATO).

This guide will explore the qualifications and role of a BAS agent, the benefits of engaging said agent and how they can help simplify your BAS obligations.

Are you a business owner thinking of enlisting the services of a BAS agent? Then this guide is for you.

What Is the Role of a BAS Agent?

A Business Activity Statement (BAS) is a form submitted quarterly to the ATO by businesses registered for GST to report and pay their tax obligations.

A BAS agent is a registered professional authorised to prepare and lodge your business’s BAS and advise you on related matters.

What Is a BAS Agent Allowed To Do?

A BAS agent can

- Prepare and lodge your BAS with the ATO on your behalf, including calculating your GST obligations, reconciling your accounts, and reporting your PAYG withholding.

- Advise you on your GST obligations and help ensure your business complies with GST legislation. They can also assist you with registering for GST if necessary.

- Advise on your business’s record-keeping requirements and help you set up record-keeping systems that comply with ATO requirements.

- Represent you in your dealings with the ATO in matters related to the preparation and lodgement of BAS statements.

Engaging a BAS agent will give you peace of mind knowing your BAS obligations are being managed effectively and efficiently.

What Is a BAS Agent Not Allowed To Do?

A BAS agent cannot prepare and lodge income tax returns or fringe benefits tax (FBT).

They are also not allowed to vary PAYG or FBT instalments that appear on your BAS. Consult a registered tax agent if you need help with these matters.

BAS agents cannot discuss tax agent services with the ATO on your behalf, including negotiating payment arrangements, requesting remissions or penalties, and appealing decisions made by the ATO.

They also cannot provide legal advice on contracts or dispute resolution nor offer financial advice, such as advice on investments or superannuation.

Finally, a BAS agent cannot conduct audits of a business’s financial records or provide assurance services.

What Qualifications Do BAS Agents Need?

To qualify as a BAS agent under the Tax Practitioners Board of Australia, a person must

- Be at least 18 years of age.

- Obtain a Certificate IV in Bookkeeping or Accounting.

- Acquire at least 1,400 hours of relevant experience in the four years before applying for registration.

- Hold professional indemnity insurance that meets the Tax Practitioners Board’s requirements.

- Be a fit and proper person with no criminal convictions that would impact their ability to provide services honestly and ethically.

- Complete 45-125 hours of relevant Continuing Professional Education (CPE) every three years, depending on their agent registration type.

- Apply for registration to the Tax Practitioners Board and pay the required fees.

Do I Need a BAS Agent?

A BAS agent can provide significant value to your business by

- Saving you time. BAS agents can care for your compliance needs, allowing you to focus on running your business.

- Reducing stress. BAS agents can lodge your BAS accurately and on time, giving you peace of mind and reducing stress.

- Maximising deductions. BAS agents can help you claim all relevant deductions, potentially reducing your tax bill.

- Avoiding penalties. BAS agents can ensure you comply with all relevant tax laws and regulations, potentially avoiding costly penalties.

- Offering expert advice. BAS agents are trained professionals who are up-to-date on the latest tax laws and regulations, providing you with specialist advice and guidance.

Other FAQs About BAS Agents

What Is the Difference Between a Tax Agent and a BAS Agent?

Tax agents provide advice and services related to income tax matters and returns.

In contrast, BAS agents have the authorisation to provide services related to BAS lodgement, including GST, PAYG withholding, and other related taxes.

What Is the Act That Applies to a BAS Agent?

The Tax Agent Services Act 2009 (TASA) is the legislation that applies to BAS agents in Australia.

This act sets out the requirements for registration, the Code of Professional Conduct that BAS agents must follow, and the penalties for non-compliance.

What Is the Difference Between an Accountant and a BAS Agent?

An accountant has professional training in various financial and business matters, including tax, audit, and financial reporting.

On the other hand, a BAS agent specialises in GST, PAYG withholding, and other indirect taxes.

While both accountants and BAS agents can assist with tax-related matters, the ATO authorises BAS agents to provide BAS preparation and lodgement services.

The ATO does not require accountants to hold this authorisation.

How Much Does a BAS Agent Charge?

The cost of hiring a BAS agent will vary depending on several factors, including your business’s financial situation, the volume of transactions involved, and the level of service required.

Generally, BAS agents charge an hourly rate, which can range from around $40 to $150 or more per hour.

Some BAS agents may also charge a fixed fee for specific services, such as BAS preparation and lodgement.

Carefully evaluate your needs and budget when considering hiring a BAS agent, and shop around to compare rates and services offered by different providers.

Do You Need Help From a BAS Agent?

What is a BAS agent? This guide has shown that a BAS agent is a registered professional authorised to prepare and lodge your business’s BAS.

If you want to ensure your business meets its BAS compliance obligations, it’s time to talk to the experienced professionals here at GeekBooks.

We are one of Australia’s leading BAS services, specialising in accurate and expert BAS preparation for small businesses throughout Australia.

Complete our online booking form or call us on 02 9158 3591 for a free bookkeeping quote today!