This refers to the way that small businesses report their staff payment details to the ATO for taxation purposes.

Single Touch Payroll has been in place since 2017 in Australia and in that time, it has been rolled out to include all small businesses with more than 20 employees.

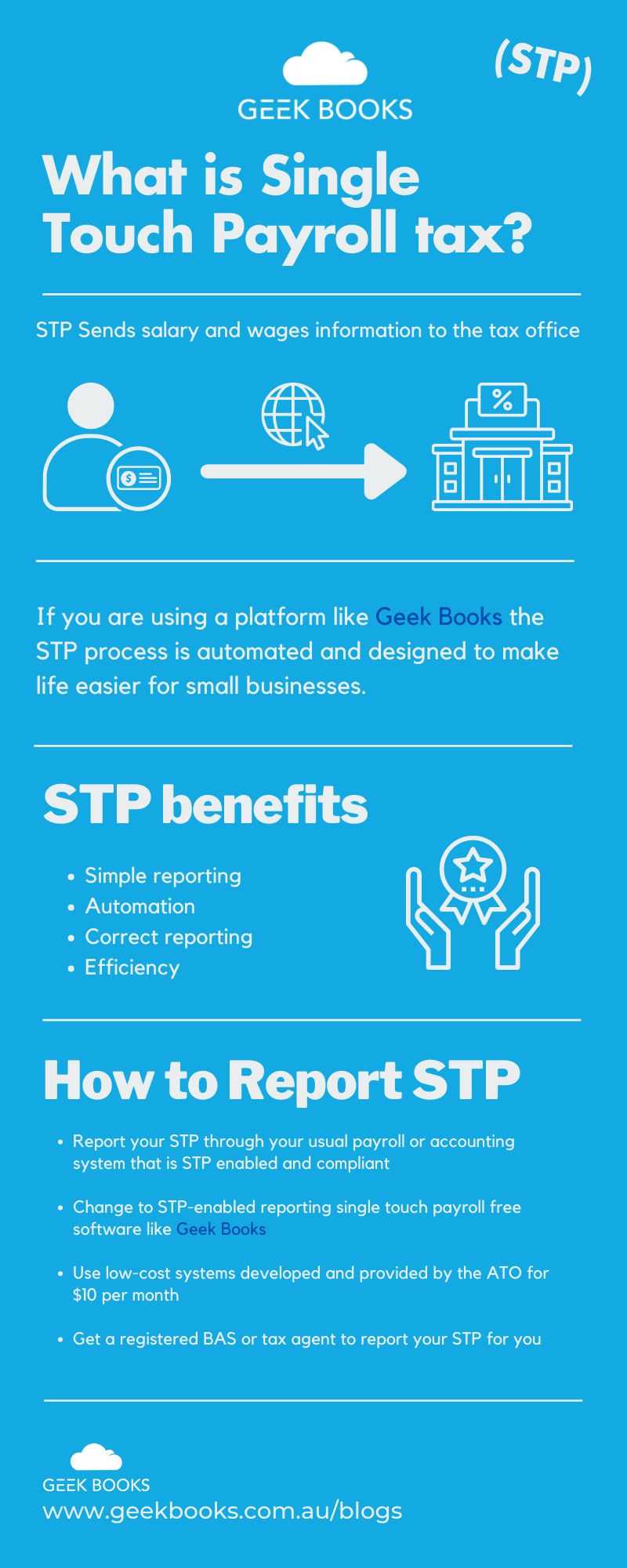

Single Touch Payroll (STP) is a compliance regulation of the Australian Tax Office that requires employers to send salary and wages information to the tax office at the same time they carry out their payroll for employees.

The ATO used to request this information from businesses once a year, however, this began to change from 2018 when single touch payroll (STP) was first introduced for small businesses.

SMEs now submit a report every payday as part of their routine, and these reports must be in a specific format and submitted digitally.

Businesses are now compelled to send through all information on salaries and wages, superannuation and pay as you go (PAYG) withholding through their accountancy company or software as part of ATO compliance.

The level of information that must be provided to the ATO was expanded from January 1, 2022, to include employment types, gross income and other information.

This is designed to reduce the reporting frequency and complications that small businesses previously had to be compliant with.

STP means that regularly reporting enables them to be compliant without the need to compile reams of information at tax time.

Many Australian small businesses are already using STP, but there are still small businesses that are not compliant with this new reporting method. If your small business is not yet using STP, it is crucial that you start reporting your staff payment information to the ATO using this method now.

This article will outline how you can start using STP and the benefits and advantages it will offer your small business.

What is single touch payroll?

Fortunately, this process is very simple. If you’re using payroll software through the internet that is STP compliant, the process is done automatically.

There will be some initial setup to complete if you are using a platform like GeekBooks for the first time, but for the most part, the STP process is automated and designed to make life easier for small businesses.

If you’re still using manual, offline payroll systems then the process is a little bit more complicated. You will need to find a provider (an accountant or bookkeeping service) that can convert your manual payroll into the correct format and submit it to the ATO in a compliant form.

Before 2018, small businesses were required to send through this information in an annual payment summary report.

This meant manually compiling all wages paid throughout the financial year, superannuation and PAYG and submitting it to the ATO.

On top of the summary of the entire business, individual reports need to be submitted for each employee detailing the same information as well.

The new system is a lot more simple and automated to save that tax time crunch for small businesses.

You will also need to conduct an EOFY finalisation on your STP by July 14 every year.

If you cannot finalise your STP by this date, you can contact the ATO and apply for a deferral.

However, it’s important to have this finalised on time because this will impact the length of time it takes for employees to claim their income tax returns.

There have been several changes made to STP in phase two of the rollout in Australia by the ATO as well.

This includes disaggregation of gross, employee taxation conditions, the classification of income types, country codes, wage deductions and child support garnishees, and the reporting of former Business Management Software IDs and Payroll IDs.

For more information on these changes, you can visit the official ATO website.

STP benefits: Why is it important?

While changes to tax compliance and reporting can sound daunting at first, STP has been designed to benefit small businesses in many ways. Some of the benefits you will experience by using STP-compliant reporting software include:

Simple reporting: By streamlining all of your ATO reporting and compliance with your regular employee payments, small businesses will spend less time meeting their tax requirements and enjoy automated compliance.

Automation: Many of the PAYG sections of your business activity statement will be automatically filled out to save you time and effort.

Correct reporting: The automated elements of STP will reduce instances of human error which can lead to incorrect information being submitted and penalties from the ATO.

Efficiency: Because your ATO requirements are rolled into your regular employee payments there is less double handling.

Payment summaries are no longer required: All of the data that is collected through STP is then placed on the MyGov platform for employees to access.

This includes all of the information around their tax paid to date and superannuation contributions.

This saves employees the effort and expense of creating and distributing payment summaries for each pay run.

It helps eliminate paper operations: By moving all reporting and employee summaries online, there is no requirement to create paper records which is better for business operations and the environment.

Ensuring that your small business is STP compliant is not only convenient, it’s essential.

The penalties for non-compliance with STP rules were waived for the first 12 months after it was introduced in 2018, but these penalties now apply, so compliance is imperative.

Single touch payroll exemptions

Closely held payees by small employers were previously permitted under the single touch payroll legislation. A closely held payee receives payments from the entity in which they are directly associated.

Examples would include members of a family business, board members or shareholders of a corporation, or beneficiaries of a trust.

These exemptions have now expired and small businesses are required to report payments to closely held payees.

STP reporting is exempt for employers with a withholding payer number (WPN) until the end of the financial year 2022–23.

From 1 July 2023, these payments must be reported through STP.

The ATO does not need to be notified or informed if you decide to use this exemption.

Documentation supporting your decision should be maintained, however.

STP reporting is not required for small employers with fewer than 19 employees if they meet any of the following qualifications:

- Limited or no digital capabilities.

- Limited or no internet access.

- Other unusual circumstances (these will be considered by the ATO).

If your business is located in an area where there is no internet service, you may be able to apply for an STP exemption for one or more years.

Registered tax agents and BAS agents can also apply on behalf of employers for exemptions.

How to report STP

There are various methods you can use to report STP to the Australian Tax Office, including:

- Report your STP through your usual payroll or accounting system that is STP enabled and compliant

- Change to STP-enabled reporting single touch payroll free software like Geek Books

- Use low-cost systems developed and provided by the ATO for $10 per month

- Get a registered BAS or tax agent to report your STP for you

How you report your STP each pay run depends on the payroll solution you choose.

There are three different methods of sending STP information to the ATO, including:

- Directly from your STP-compliant accounting software platform

- Via a third party that is integrated into your STP-compliant accounting software platform

- Via a third party outside of your software, like a registered accountant, bookkeeping service or tax agent

The most simple method is to use any modern, compliant accountancy software that will simplify and streamline all of your payroll and STP requirements.

This process is affordable and simple to use for most businesses.

If you are in a region where there is limited or no internet connection, like a rural or regional area of Australia, exemptions are available until the end of the 2022/23 financial year.

For business owners that may struggle with technology and online reporting, enlisting the assistance of a registered tax or BAS agent will enable you to ensure all of your STP reporting is lodged correctly and that your business is compliant.

5 Common Single Touch Payroll FAQs

While the process of using STP is simple, there can be many curveballs that small businesses face which will impact their ability to file this information.

These are some of the leading variables that face small businesses and the questions they commonly ask about STP:

How do I account for employees who have been terminated or left the business?

When the employees’ final payment and entitlements have been processed in your accounting software (and there are no more payments due to be made to them during the financial year), a finalisation checkbox appears.

When you check this, the information is sent to the ATO and they are notified there will be no further payments made to that employee from your business.

Is it still necessary to provide my employees with Payment Summaries?

According to the ATO, you will not have to provide your employees with a payment summary when you have reported and finalised the information through STP.

After you have finalised your data, your staff or their registered tax agents can use the STP information in ATO online to file their income tax returns.

Employees can view their income statements in their MyGov account under the Income Statement tab.

Former employees can also view their income statements.

If I’ve paid my employees throughout the year, why is it necessary to ensure that my payroll data is complete and accurate?

Usually, an employee’s name and bank information were all that was required for a pay run before STP.

When STP reporting is used, employers are required to submit additional information.

Therefore, you should review your onboarding processes to ensure new employees’ information is kept accurate and complete from the outset.

What should I do if I’ve made an error in my payroll and sent the ATO wrong data?

The recommended solution, if you have already sent the STP information to the ATO, is to create an adjustment pay run.

This is not the only method, though. You can also un-apply the data you have submitted so you can edit the pay run you have submitted.

However, when you re-apply this information it will not be sent through to the ATO until the next pay run.

If no withholding is made on payments, then your business will not be required to make any corrections to payroll data.

You should also ensure that the PAYG figures are not the pre-filled figures on your BAS (after your change), since it may automatically pre-fill it with the original data.

Does STP require employee numbers?

Yes, the ATO requires this. As data matching requires an employee number, all employees must have one and employers must submit them through STP.

An employee number is not the same as the TFN.

These are the internal numbers assigned to staff members for classification purposes.

In summary, single touch payroll is here to stay and it’s a requirement for all small businesses to report staff payment information, tax details and superannuation to the ATO with each pay run.

Unless your small business has an exemption (which usually only applies to businesses in rural and remote areas where there is no internet access), you are required to use STP to report to the ATO.

Instead of being a burden to small businesses, this helps reduce labour, eliminate errors and inefficiencies and make it simpler for your staff to view information like their tax paid to date and their current superannuation balance.

It’s simple to move your reporting processes online and there are many software platforms available that enable you to report through STP when you carry out your regular pay runs.

For more information on how Geek Books can simplify STP and your payroll obligations, contact us today.