As a business owner, pouring over spreadsheets is probably not your favourite pastime.

Think of spreadsheets as your business’ scorecard – a detailed account of how well you’re doing.

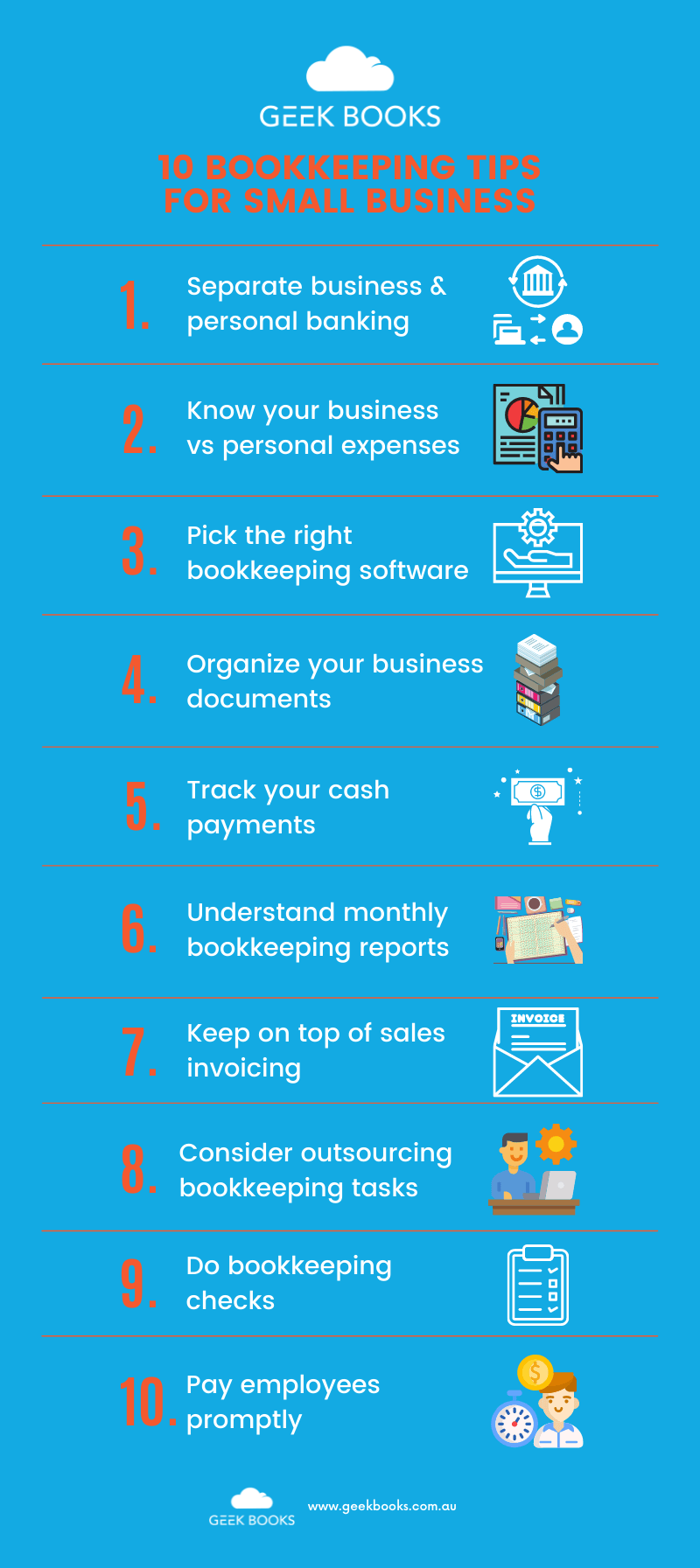

With easy-to-follow bookkeeping tips, we’ll show you how to: separate business and personal banking and expenses, find the right software, understand monthly reports, keep track of invoices and cash payments and much more.

Business owners wear many hats.

After all, you have to manage day-to-day operations, interact with customers, create and enact marketing strategies, network with fellow business owners and more.

Unsurprisingly, it’s hard to find time to scrutinise spreadsheets, balance the books and manage cash flow.

An article from BOQ found that one of the main reasons businesses fail is due to problems in managing cash flow.

In fact, in up to 50% of cases, this is due to basic bookkeeping knowledge.

So, to make the task easier, we’ve compiled 10 of the best bookkeeping tips. You might also want to familiarise yourself with these common bookkeeping terms.

Bookkeeping Tips for Small Businesses

While it may seem daunting, bookkeeping offers many benefits to small business owners. The first thing to note is the difference between bookkeeping vs accounting.

So, what is Bookkeeping? It helps you understand your financial position, improve decision making, increase financial security and improve problem-solving, to name a few. Check out our bookkeeper duties checklist for a full run-down of the daily responsibilities of a bookkeeper.

There are basic tasks every small business owner can perform to make bookkeeping less stressful. For a quick summary be sure to check out our bookkeeping guide or bookkeeping for beginners.

Let’s explore these bookkeeping tips in detail below.

1. Separate business & personal banking

An essential task when starting a business is opening a dedicated bank account. However, it’s something many new business owners neglect to do. Consequently, keeping personal and business expenses together causes major headaches down the line.

Separating these expenses enables you to keep track of your personal and business funds.

If you don’t do so, you’ll waste valuable time processing personal expense transactions within your company bookkeeping.

Worse, you’ll waste even more time and money getting a professional bookkeeper to separate these expenses for you.

Any personal expenses will be painstakingly entered into the bookkeeping system and coded to drawings.

To ensure you always have cash handy for business expenses, we suggest opening a business savings account.

This also allows you to put money aside for quarterly tax payments.

Simply calculate between 25-30% of your income, and place it in the business savings account.

2. Know your business v. personal expenses

If you’re a sole trader, you’ll likely withdraw money from your business account for personal use (drawings).

You can do this rather than paying yourself a salary. A good habit is to transfer an amount regularly (i.e. weekly) into your personal account.

This is used for bills, groceries, etc.

Then, the business account can house only business transactions and the regular drawing amount.

This ensures you won’t charge a private purchase to the business.

It’s essential to know the difference between personal and business expenses.

You need to know exactly what can be claimed against business profits to reduce tax, and what cannot.

Here’s a general guide:

• Expenses directly connected to the operation of your business and income generation is mostly tax-deductible, whereas;

• Combining personal with business does not guarantee a claim for your business is acceptable (i.e. having dinner with clients or purchasing gifts for them)

If you are unsure whether to claim an expense, contact the ATO or your accountant.

3. Pick the right bookkeeping software

The accounting software you choose depends on your individual business requirements.

Software manufacturers offer various features, including:

• Cashbook

• Cashbook and Ledger

• Ledger, Inventory and Cashbook

• Cashbook Ledger, Inventory and Foreign Currency Transactions, and;

• Cashbook, Ledger, Foreign Currency Transactions, Inventory and Point of Sale

At a minimum, you’ll need Cashbook, which can easily be created using Excel.

If your business is expanding, you will require software that provides Cashbook, Ledger, Accounts Receivable and Payable and Bank Reconciliation features.

However, if your budget is tight, there are several free options that are up-to-date and offer comprehensive features (similar to those mentioned above).

In fact, you can accomplish the majority of bookkeeping tasks using programs such as Excel, or its free alternative, OpenOffice Spreadsheet.

Whether free or paid software, most options provide bookkeeping templates, and allow you to export reports to Excel to customise and manipulate, produce charts and combine different aspects of reports from different periods.

4. Organise your business documents

The key to successful bookkeeping is ensuring all your business transactions are in order.

These are referred to as accounting source documents. Keeping these allows for:

Easy tracking for future queries, and;

Concrete proof to your auditor or the tax department of what took place

To provide proof of profit, loss and expenses, you are required to keep wage records, receipts and invoices, among others.

As a general rule, the tax department requires you to keep pertinent documents to back up your tax claims for at least five to seven years.

To compile your records, ensure you have a well-organised archiving and filing system.

The three key options are:

• On paper

• On your computer’s hard-drive, or;

• Storing documents online

5. Track your cash payments

Any cash payments you receive from customers should be put directly into a business bank account or petty cash.

Although, many business owners are tempted to invest it right into business supplies.

While this may seem like a wise choice, it can create problems in your bookkeeping.

For instance, the bookkeeper or business owner may:

– Forget which customer(s) paid the money.

This can be embarrassing for the customer, and may even be considered tax evasion (due to undeclared income).

– Neglect to include the item purchase in the books.

These expenses must be entered, as they help lower your tax bill.

If either of these areas is overlooked, your bookkeeping system will not provide a true financial record of your earnings.

6. Understand monthly bookkeeping reports

Not all business owners go into it with a “business mindset”.

Put simply, they do not invest enough time into the behind the scenes tasks (such as bookkeeping), which keep everything running smoothly.

Unsurprisingly, a large number of people do not know if their approach is producing results until it is too late.

In many cases, this is when no profit is generating and they have massive debt.

Fortunately, you can avoid this grim situation.

Just ensure your bookkeeping system is always up to date by producing comprehensive quarterly reports.

Each quarter search for trends (i.e. sales growth or decline, year-over-year revenues, or the frequency of customers who pay late).

When running a business, it’s vital that you understand these reports.

The most important ones for small business owners are the:

Balance sheet – A concise summation of assets, equity and liabilities.

It is a financial report which provides an overview of your company’s current financial position.

Income statement – Commonly referred to as a “profit and loss statement”, this report details income, minus expenses.

For assistance, our team is ready to help you compile your balance sheet and income statement.

7. Keep on top of sales invoicing

When a job is completed, most people prefer to pay the invoice right away, so there’s nothing as frustrating as waiting for months.

To customers, this appears disorganised. Not only that, but it can prove harmful to your cash flow.

The importance of issuing invoices to customers in a timely manner cannot be overstated.

They are the lifeblood of any business.

To ensure income continues to roll in, send invoices out at the completion of the job or on a regular basis (i.e. monthly).

This way, you’ll have a guaranteed regular income stream and the assurance that your suppliers will be paid on time.

It is important to point out that this does not apply to businesses operating on a cash-only basis.

The reason being, the cash is paid at the point of sale.

8. Consider outsourcing bookkeeping tasks

Oftentimes, business owners are stretched far too thin. Along with delivering your product or service, you may find yourself in the role of administrator, marketer, bookkeeper and more.

Are you finding bookkeeping too difficult or time-consuming? Are you spending too much time trying to get your head around things like what is double entry bookkeeping?

If so, we encourage you to consider outsourcing. Among its many benefits, outsourcing is:

Cost-effective – You’ll only pay for the one job to be completed, rather than paying for a regular wage, and;

Accurate – You can be confident your bookkeeping is being done by a professional.

So, you can rest assured it is done correctly and to the highest standard.

When you hire a professional bookkeeper, they can process a month’s worth of bank transactions, finalise your bank reconciliations and produce a comprehensive report in a few short hours.

Beyond their typical duties, an experienced bookkeeper can also give you valuable business advice, such as:

• Advise whether new software will suit your business needs

• Attend the business meetings between yourself and your banker, to articulately explain the state of your business’ finances

• Prepare your cash flow reports and yearly budget

• Train your employees, and more.

If you’re wondering how much does a bookkeeper cost, you can find out more here.

9. Do bookkeeping checks

Do you employ an office administrator to do your bookkeeping?

While they may be helpful, if bookkeeping is not their area of expertise, it’s essential to check their work.

Always remember, even if they sound like they know what they’re talking about, that doesn’t mean they are doing the bookkeeping correctly.

So, get involved in the financial side of things – take a real interest in your business’s financial position.

As your business expands, ensure you perform “checks” when the monthly bookkeeping is done.

This way, the burden isn’t placed on one person and a fresh pair of eyes can find things that may have been missed, such as:

• One person reconciles all bank statements and bills and enters them into the system.

Another person checks these details and sets up bank payments, and you approve these payments.

And;

• One person issues and receives cash (i.e. through petty cash), and someone else can reconcile the cash box each month.

10. Pay employees promptly

If you employ people, it’s vital to pay their salaries/wages on time. Remember, employees depend on their regular paycheque to ensure they can pay the bills.

Whenever you pay your employees (i.e. fortnightly, monthly, etc.) remember to put some of it aside for payroll tax.

And, just like paying employees, ensure you file payroll tax on time.

Neglecting to do this on time can incur massive fines, which is a real waste of your money.

If you feel confident, you can attempt to do your company’s payroll tax manually.

Many business owners don’t choose this option, however, as it can prove difficult and time-consuming.

Otherwise, there are many fairly priced payroll tax software programs available either as desktop applications or online, which help you complete the task efficiently and hassle-free. If not, you can always hire a professional to handle your company’s payroll tax requirements.

In summary, whether you’re a startup or a large business, these top bookkeeping tips are certain to make life simpler.

If you are confident, you can certainly perform these tasks yourself.

However, keep in mind that the experts at Geekbooks are ready and waiting to assist you with everything from compiling monthly reports, to submitting payroll tax, sales invoicing, reconciling bank payments and so much more.

If the prospect of performing bookkeeping duties seems overwhelming, call or email the experts at Geekbooks today.