With the correct information and insight, bookkeeping for beginners doesn’t mean jumping into the deep end without any preparation.

The internet is stuffed full of valuable resources for just about any career prospect – and bookkeeping is no exception to that rule.

If you want to know more about bookkeeping for beginners and small businesses, we’ve covered everything you need from the Bas services that a bookkeeper provides to the best practices that should be followed.

With businesses looking for bookkeepers that can do a bit of everything, from high-quality technical services to teamwork and communication, basic bookkeeping for beginners is more than just balancing the books.

Read on now to find out more.

Bookkeeping for beginners: Guide for 2022

Ever wanted to know how to start in bookkeeping, or what a bookkeeper does?

Our guide to basic business bookkeeping for beginners covers everything you’ve ever wanted to know about this particular area of accounting.

As a versatile skill set and specialisation that every business needs, bookkeepers offer a vitally important service day-in, day-out. You can check out our bookkeeper duties checklist for a full picture of what the role of a bookkeeper involves.

So, what are the benefits of knowing the bookkeeping principles for beginners or learning how to do small business bookkeeping?

Finances are an integral part of your business, from ensuring your employees are paid on time through payroll to sending out invoices, making payments to suppliers to submitting your taxes.

A bookkeeper is a person that is central to making your finances work for you, whether it’s through monthly reconciliations, annual reporting, or regular data entry.

Our bookkeeping tips for beginners cover the foundations of what bookkeeping is, what bookkeeping services include, and all the terms you need to know.

If you’re ready to learn more about small business bookkeeping for beginners, this is the place to start.

1. Getting started

Before you can get into the bulk of bookkeeping duties, you’ll need to set yourself up with the technology and tools required to do the job.

At the very least, any business should be recording their incomings and outgoings clearly and accurately.

This may be through an old-school accounts book, or more likely, through a digital spreadsheet.

The majority of bookkeepers make use of dedicated accounting software to provide their services.

Purpose-built platforms offer the best compatibility and ease of use when it comes to managing everyday finances.

In addition to standard bookkeeping software, you’ll need access to additional tools depending on the other services required.

Payroll, for example, may use dedicated software, or this process can be done through a range of different general bookkeeping accounting platforms for easy accessibility.

Reporting, sending invoices and tax preparation are also often covered by generalised accounting software, though you can use separate platforms if you prefer.

2. Bookkeeper vs. Accountant vs. DIY

How do you know if a bookkeeper is a suitable choice for you?

In smaller businesses, the lines between ‘accountant’ roles and ‘bookkeeper’ roles can be more blurred than you might expect.

But looking at the bigger picture, the job of a bookkeeper is to focus on the small details.

That means payroll, keeping bills paid, ensuring all records are up-to-date and dealing with all of the everyday financial needs of the average business.

Accountants, by contrast, tend to look at the bigger picture.

That means they create reports, help you plan financially, and allow you to project how your business could be doing months or years from now.

This allows companies to make those big, important financial decisions based on financial specialists’ collated data and expert predictions.

So, where does DIY fit into the mix?

While qualified bookkeepers and accountants require formal training and certification to do their jobs, bookkeeping for beginners in small businesses often falls to general HR or even the business owner to handle.

DIY bookkeepers don’t have formal training, which means they need to rely on the quality of their software or their ability to learn quickly to do the best job possible.

If you need a qualified and trained professional to handle day to day finances in your business, a bookkeeper is your best bet.

If you want someone that can aid in financial planning and creating valuable reports, an accountant may fit your needs.

DIY can fit the mould for startups and businesses with minimal finances or lack of funds for hire.

3. Types of bookkeeping you should know

Any bookkeeping tutorial for beginners should cover the different responsibilities and types of bookkeeping you are likely to encounter.

Here are some of the most basic bookkeeping terms you’ll need to know:

• Cash

Cash and cash flow refer to the actual transactions that go out of a business. Cash is part of the ‘book’ part of bookkeeping and involves accurately recording everything that goes out as disbursements or expenses.

This information is used for reporting, taxes, and more.

• Accounts Receivable

Accounts receivable keep track of the payments that other people owe you, whether it’s customers or suppliers.

This includes the creation of invoices for payment and the recording of all money that comes in.

• Inventory

If your business has a stock of products, the inventory is where this stock is listed, ready to be reported on or replenished as and when needed.

Inventory is typically reported to bookkeepers, who then record the information accurately.

• Accounts Payable

This refers to any money that leaves a business account or is due to do so for payment.

A bookkeeper can make sure everything is paid on time and that everything is reported as and when payments happen.

• Loans Payable

This specific type of bookkeeping involves tracking loans and other credit, often with a supplier or a bank.

The bookkeeper ensures timely payment of loans payable and accurately reports how much is owed.

• Sales

Sales are a vital part of any business. In terms of bookkeeping, sales refer to income into your business, specifically from sales transactions.

Whether you’re a retail business or a huge B2B organisation, a bookkeeper will record sales accurately and quickly to give you a clear overview of your current financial status.

• Purchases

Purchases are anything you buy for your business, which a bookkeeper then records carefully for use in tax season.

Purchases are a part of your gross profit calculation, making accuracy extremely important.

• Payroll Expenses

Salaries and wages are payroll expenses, and a bookkeeper can take complete responsibility to ensure everyone is paid on time and recorded correctly.

• Retained Earnings

This refers to any profits reinvested into the business instead of paid out to owners.

This provides a clear view of how much money your company has retained over time.

4. Bookkeeping best practices you should follow

Bookkeeping for beginners can be overwhelming, but following these best practices can mean the difference between making a mess of your finances or keeping your business ticking over with excellent money management.

Here are some of the best practices you should keep in mind:

- Keep Personal and Business Finances Separate: It’s integral for smaller businesses and startups to have a clear line between what is business and what is personal for tax reporting.

- Establish Internal Controls: Controls help prevent problems and ensure your finances are reported accurately with less risk of fraud.

- Choose an Accounting Method to Use: Having a standard system can ensure the long-term success of your accounting and prevent confusing conversions in tax season.

- Use Accounting Software to Track Expenses: The right software can save time, improve accuracy and provide timely reporting swiftly and effectively.

- Track Employee Time (to understand your profitability): By looking at timesheets and payroll systems, you’re able to see how profitable your employee’s work is.

- Optimise Your Chart of Accounts: The more streamlined your chart of accounts, the easier it is to use for tax and compliance and use in management accounting tools.

- Download Banking Transactions Daily: Getting into a daily routine saves work building up and ensures your reporting is pinpoint accurate at all times.

- Reconcile Bank Statements Regularly: Regular reconciliation can help prevent discrepancies between your in-account finances and how you look on your books.

- Resolve Issues Promptly: Notice a problem with your bookkeeping? Don’t let it fester. The faster you fix it, the easier it will be.

- Evaluate Your Financial Data Monthly: Monthly reporting and evaluations can help you make the best use of the data you gather and spot any problems quickly.

- Plan for Taxes Throughout the Year: Don’t leave tax to the last minute. With clever planning and professional bookkeeping, taxes don’t have to be a headache.

- Keep Clean and Thorough Records: Your records should be easy for anyone else to pick up if they need to, preventing problems with reporting and evaluation later down the line.

- Speak with a Bookkeeping Consultant Regularly: Working with an expert is always the right choice for your finances.

You can find more bookkeeping tips from the experts at GeekBooks here.

5. Bookkeeping terms you need to know

When it comes to double-entry bookkeeping for beginners or any other kind of financial management, there are a few terms you should know:

- Balance Sheet: your balance sheet is a report or spreadsheet that shows the overall picture of a businesses finance. This uses assets, liabilities and overall capital to show how much the business owns and how much it owes.

- Chart of Accounts: This is a complete list of all the accounts used within your businesses for financial purposes. Income, equity, assets and liability are some of the included accounts.

- Expense: This is anything that comes out of your business as a result of running operations. This could be a standard one-off cost, accrued costs or long-term fixed or variable expenses.

- Trial Balance: This is a method used by bookkeepers to check the mathematical correctness of the accounts. Every ledger is compiled into a credit and debit column for a full calculation.

- Profit and Loss: This is a specific report that shows the expenses and revenue a business has made over a set amount of time – usually quarterly and yearly.

What is double entry booking itself? Find out more here.

6. Learning Bookkeeping

If you want to learn how to do bookkeeping for your business, or you’re someone that’s always been interested in learning about accounting, the best place to start is with a formal qualification.

A Certificate IV Accounting and Bookkeeping or a Diploma in Accounting is an excellent way to access formal training.

Depending on your choice of bookkeeping platform, you may also access tutorials and guidance with that specific service in mind.

Beginner Bookkeeping FAQs

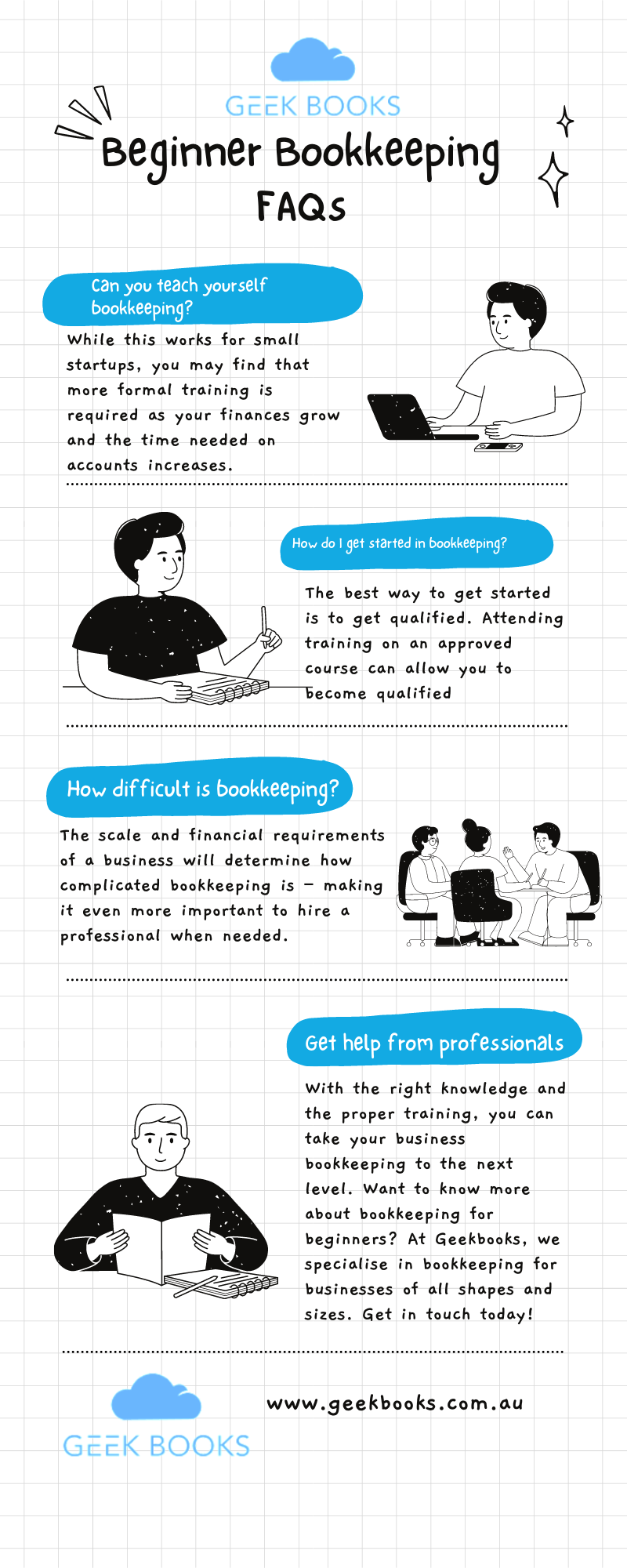

Can you teach yourself bookkeeping?

Many small business owners choose to teach themselves bookkeeping to manage their accounts. It also helps that there are various free bookkeeping templates out there to make things easier for you.

While this works for small startups, you may find that more formal training is required as your finances grow and the time needed on accounts increases.

Hiring a professional is the best choice if you’re unable to continue to handle your finances by DIY. Wondering, how much does a bookkeeper cost? Learn more here.

How do I get started in bookkeeping?

The best way to get started is to get qualified.

Attending training on an approved course can allow you to become qualified, and help you gain valuable experience in starting bookkeeping.

This is valuable whether you’d like to work as a bookkeeper or want to handle finances for your own business.

Can you be a bookkeeper with no experience?

If you have no experience in bookkeeping, starting with training can ensure you have the skills and knowledge to carry out the work.

When you receive training, you’ll be able to trial the responsibilities of a bookkeeper in a safe setting.

You can also go on to do apprenticeships or work experience as needed.

How difficult is bookkeeping?

Bookkeeping can be a challenge for small businesses as they grow.

While startups may find simple finances easy to handle, accounts are often forgotten or delayed as companies grow.

The scale and financial requirements of a business will determine how complicated bookkeeping is – making it even more important to hire a professional when needed.

What qualifications do you need for bookkeeping?

To be a bookkeeper in Australia, you’ll need a Certificate IV Accounting and Bookkeeping or a Diploma in Accounting from a suitable place of education.

From there, you can gain experience and improve upon your learning with software-specific courses or through work experience.

Summary

With the right knowledge and the proper training, you can take your business bookkeeping to the next level.

Want to know more about bookkeeping for beginners? At Geekbooks, we specialise in bookkeeping for businesses of all shapes and sizes.

From payroll to tax preparation, we do it all.

Take a look at our updated bookkeeping guide or get in touch with our team today to find out more.