Employers in all states and territories of Australia are required by law to remit payroll taxes to the Australian Tax Office (ATO).

Individual state and territory governments collect the tax in relation to employees’ assessed earnings that are paid or payable by their employers.

Employers have to calculate their own tax liability, and they must pay it to the Office of State Revenue in their state or territory.

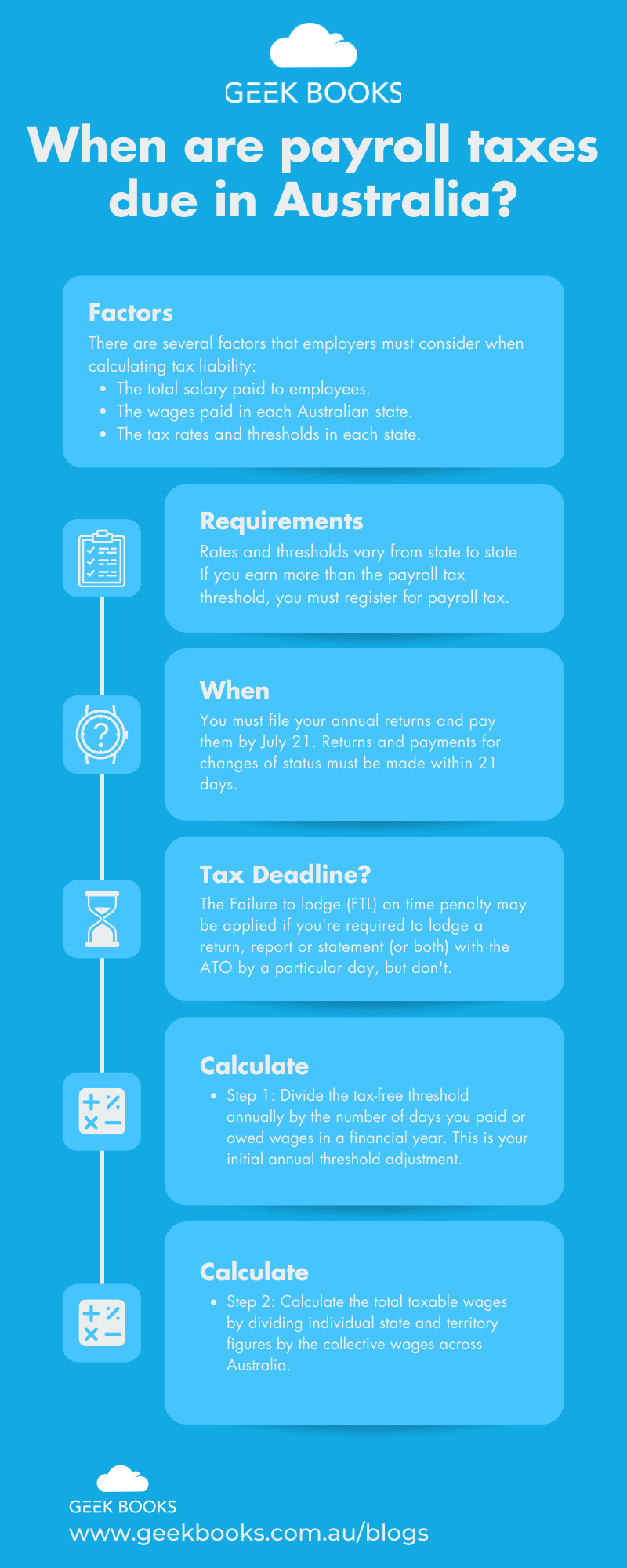

There are several factors that employers must consider when calculating tax liability:

- The total salary paid to employees in locations around Australia.

- The wages paid in each Australian state.

- The tax rates and thresholds in each state.

State law determines how these payroll taxes should be calculated.

Because of this, each state and territory has its own requirements for calculating tax liability.

Payroll taxes aren’t required for all businesses.

As soon as your overall Australian income exceeds the tax-free threshold for your state or territory, you need to pay taxes.

Rates and thresholds vary from state to state.

If you earn more than the payroll tax threshold, you must register for payroll tax.

Find out what the threshold is for the states or territories where you have paid workers.

The thresholds and payroll tax rates can be found on the revenue office website of your state or territory:

So when are your payroll taxes due to be lodged?

All periodic payments and returns need to be lodged within seven days of the conclusion of the return period, which can be monthly or half-yearly.

If your due date happens to fall on a public holiday or a weekend, you are required to lodge your payroll taxes the next business day.

You must file your annual returns and pay them by July 21.

Returns and payments for changes of status must be made within 21 days.

What happens if I miss the payroll tax deadline?

The Failure to lodge (FTL) on time penalty may be applied if you’re required to lodge a return, report or statement (or both) with the ATO by a particular day, but don’t.

Fortunately, the ATO understands that life can get in the way and that people may miss lodging their obligations on time.

If you only miss a reporting period once, you are unlikely to attract any penalties.

Instead, you’ll receive a warning letter to remind you to lodge your obligations on time in the future.

This only becomes an issue if it’s a repeated occurrence.

If the ATO apply the FTL penalty tax, they will send you a penalty notice stating the amount and due date of the penalty.

If your business accrues numerous FTLs or the lodgement is excessively late, some penalties can apply.

Generally, a small entity may have an FTL penalty of up to five penalty units if its returns or statements are overdue by 28 days (or part thereof).

This penalty is doubled for a medium entity.

For PAYG withholding purposes, a medium entity is one with an annual assessable income greater than $1 million and less than $20 million, or a GST turnover above $1 million.

The penalty is five times as high for large entities.

The definition of a large entity is an entity that has assessed income or GST turnover of $20 million or higher or is a large withholder for PAYG withholding purposes.

An entity that is significant globally is penalised by 500 times the base penalty amount.

The base penalty rate depends on when the FTL infringement occurred.

From December 27, 2012, this penalty rate is $110.

Between December 28, 2012, and July 30 2015 the rate is $170.

The period between July 31, 2015, and June 30, 2017, is $180.

From July 1, 2017, to June 30, 2020, the base penalty rate is $210.

For all FTL infringements after July 1, 2020, the penalty rate is $222.

Where do my payroll taxes go?

Payroll taxes and stamp duties are the main sources of tax revenue for states and territories in Australia. Land, gambling, and motor vehicle taxes are also imposed by states.

The rest of the money used by state and territory governments is issued by the Federal Government.

States and territories spend payroll tax, stamp duty fees and Federal Government contributions on state-run assets and operations including roads, housing, prisons, public transport and emergency services.

How do I calculate my payroll tax?

In Australia, payroll tax rates will be determined by the total wages an employer earns in the country.

In the case of groups, the total Australian wages of the group will be used.

Employers cannot determine the payroll tax rate they will pay until the annual reconciliation process has been completed each July.

The payroll tax rate will be calculated based on employers’ estimated taxable Australian wages for the current financial year to allow them to lodge and pay payroll tax monthly returns.

A reconciliation process will be carried out annually to determine if the estimated payroll tax was greater than the actual payroll tax, and any overpayment or underpayment of payroll tax will be resolved.

As a result:

Businesses are entitled to a refund when their estimated tax for the fiscal year exceeds their actual tax for the year.

However, the business will be required to pay any shortfall that arises out of the annual reconciliation process when the estimated tax is lower than the actual tax for the financial year.

Although states and territories are working toward harmonising payroll tax requirements and details, there are still variables depending on which part of Australia your business is located (and which states and territories you have paid employees in).

The threshold and percentage rate you are obligated to pay can vary between different states and territories.

To determine your liability, you are best finding a payroll tax calculator for the states and territories where you have paid employees.

The tax-free threshold is not claimed: An employer or designated group employer can elect to omit the tax-free threshold from their monthly returns.

The annual reconciliation return may, however, be an option they want to keep open.

You take advantage of the tax-free threshold:

If you are an employer or designated group employer, you can claim the tax-free threshold in either your monthly return or your annual reconciliation return.

To claim the tax-free threshold, you must declare the total salary for your entire business across both states and territories, state or territory group salaries (where applicable) and Australian-wide salaries for each reporting period.

You will automatically be charged tax when submitting your return online based on the wages you entered and your employment status.

Use these steps for the annual reconciliation return and steps two and three for monthly reconciliation returns for the calculation of your payroll tax owed for a given period.

- Step 1: Divide the tax-free threshold annually by the number of days you paid or owed wages in a financial year. This is your initial annual threshold adjustment.

- Step 2: Calculate the total taxable wages by dividing individual state and territory figures by the collective wages across Australia. The final tax-free threshold amount is determined by multiplying this figure by either the initial threshold adjustment or the monthly figure depending on which is applicable.

- Step 3: The final tax-free threshold amount is subtracted from the total taxable wages for the state or territory. Multiply the remainder by the relevant state or territory payroll tax percentage rate to calculate the tax owing.

How often do I need to pay payroll tax?

In most states and territories, payroll tax is to be lodged and paid to the Revenue Department every month.

The Revenue Office can also let you know if you qualify for an exemption from payroll tax.

Your business is responsible for assessing its wage payments.

Payroll tax registration is required if your wages approach or reach the threshold in your state or territory.

You must submit a payroll tax application once your business is assessed as having reached the threshold.

Many of these can be completed online.

You can determine your wage payment levels using accounting software platforms such as Geek Books.

Each state audits the wage payments made by businesses regularly, so following payroll tax obligations strictly is critical.

Do payroll taxes differ from territory to territory?

Yes, the payroll tax rates and thresholds vary between states and territories.

Returns are lodged, and payment of liability is made at a pre-determined frequency (that can include monthly, annually or quarterly) to the designated revenue office located in the Australian state and/or territory in which the wage payments are classified as being liable.

All Australian states and territories have harmonised several key areas of payroll tax administration.

Information and Revenue Rulings on the harmonised key areas are accessible from the Payroll Tax Australia website.

In the case that you have staff working in the Indian Ocean Territories, then your tax liability will still be calculated following Western Australian legislation.

The final Word

Payroll tax is an important part of the revenue stream for each state and territory but the onus is on businesses to ensure they are paying the right amount of this payroll tax periodically.

There are several variables involved that need to be monitored.

This includes the threshold in your state or territory and whether your wages mean you exceed this threshold and are liable for payroll tax.

It also means checking the percentage rate owed in your state or territory as this is subject to change.

You will also need to monitor the wages that you are paying in each state and territory as well as collectively across Australia.

While this might sound complicated, using bookkeeping and payroll services such as GeekBooks can simplify the process.

As your wages change, you will have access to immediate data that shows whether you are over the threshold and are consequently liable for payroll tax.

For more information on payroll tax in your state or territory (and across Australia), how to get the best tax return and Australian tax rates, give the team at Geek Books a call.